Dave Is Wrong! You CAN Retire Early With Real Estate

I’ve lately turned to YouTube videos and podcasts while I’m on the treadmill to help break the boredom.

So when I recently came across a video of a young girl asking Dave Ramsey about how she can retire early, I admit, my curiosity was piqued.

The caller was a young 20-year-old asking for Dave’s advice. She was currently on Baby Step #2 but was already looking ahead to Baby Step #4.

If you’re not familiar with Dave’s Baby Steps, here’s a related article to get you up to speed: What Are Dave Ramsey’s Baby Steps

She planned on entering a career where she could retire in her late 40’s or early 50’s.

Her main question had to do with what she could invest in NOW to allow her to access that money (instead of a 401K) earlier than normal retirement age (65).

Dave wanted her to start off heavily investing in her 401K to take advantage of compound interest.

After 10-15 years, he wanted her to shift to “bridge investing” which is putting money away in mutual funds that aren’t in a retirement account.

This confused me as I know how much Dave loves investing in real estate and is also one of the main contributors to his wealth.

To me, this is doing a disservice to this particular caller.

If you know that something works, something is good/ethical and the person would benefit based on their long-term goals, then why wouldn’t you recommend it so they can make their own decision?

That’s one of the reasons I decided to start this website. To show high income professionals that there are other ways to build wealth besides the invest in your 401k until you’re 70 recommendation that we’re all pitched.

Retire Early With Real Estate

Would you like to retire early or at least have the option to?

Or do you want to continue working only until you can access your 401k even though you may not be satisfied with your career?

For me, I love having options. (Especially when it comes to food!) So far, I still enjoy treating patients but don’t want to be chained down to something that I may not continue to enjoy.

There’s too many docs out there that have no options that unfortunately are burning out.

I don’t want that for you.

While doing research for this article, I came across the title of a book by Chad Carson that hit the nail on the head: Retire Early With Real Estate

Join the Passive Investors CircleJust A Regular Guy

The book’s author, Chad (Coach) Carson (CoachCarson.com) retired at the early age of 36. Many times when we hear stories of people retiring early, we immediately think they must have either inherited it or hit the JACKPOT with a major investment.

This isn’t the case with Chad. He’s just a regular guy like you and me. He accomplished this with, you guessed it, real estate investing.

He’s now set out helping others by coaching them as they progress through real estate investing.

Investing In Real Estate Vs The Stock Market

When I first began practicing, my focus was investing as much as I could in the only thing I knew somewhat about…the stock market.

At that time, the majority of my focus was investing in Vanguard Index funds within our practice’s retirement account.

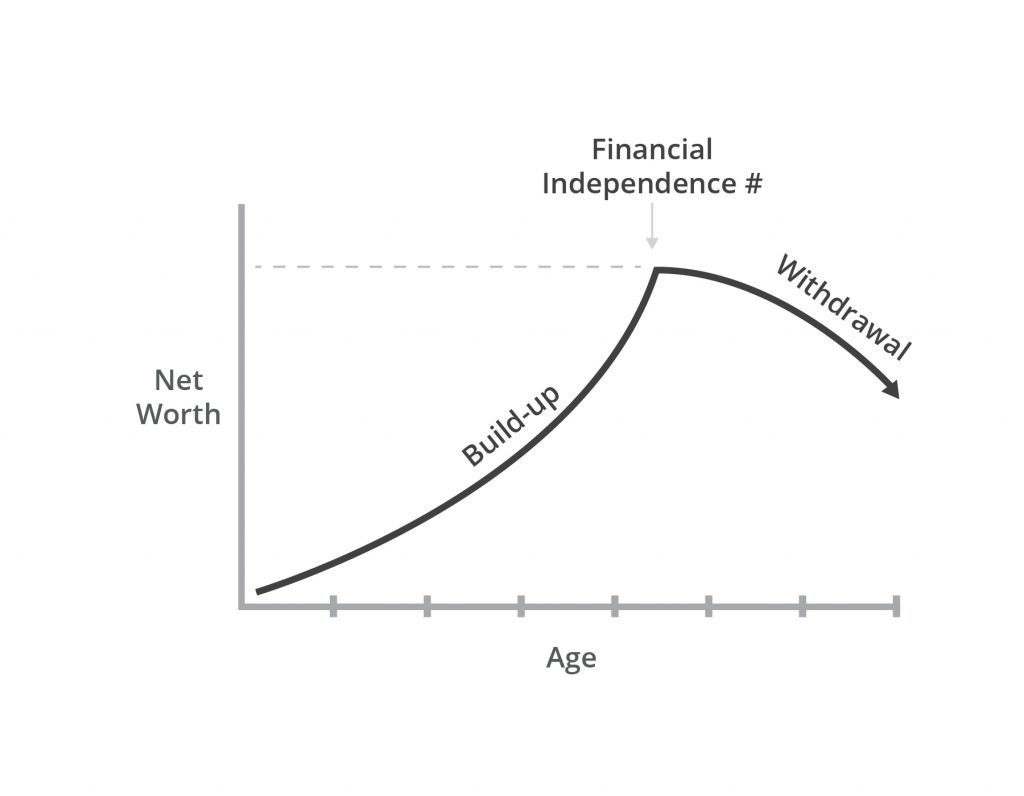

This type of investing is what is known as the “Nest Egg Theory” where we save up until we reach financial independence (FI) and then begin to live off the savings.

Here’s a chart to show what that looks like:

We still continue maxing out accounts such as 529 plans and then the remainder goes toward passive real estate syndications.

I was pleasantly surprised to see that Chad also invests the same way.

In his book, he discusses how someone can achieve financial independence investing in index funds, real estate or both.

Remember, there’s always more than one way to skin a cat.

How To Think About Money

Seems like Coach Chad and I also think about money similar as well.

Here’s his thoughts in the book:

“So, my goal with the book is to help you put money back in its place. And its place is not at the center of all your decisions. Instead, I would love your values, your friends and family, your personal goals, and your life aspirations to guide all of your decisions.” –Chad Carson

I couldn’t have said it any better. Now that I realize the MOST important thing I value most is TIME. Time with friends and family guides us on how we spend our days and weeks, NOT money.

Granted, I didn’t always think this way but realized after having kids, what the MOST important things in life were to me.

It reminds me of how King Solomon shifted his ideas about what’s meaningful in life when he wrote Ecclesiastes after the book of Proverbs.

Remember, money is ONLY a tool. Nothing more, nothing less.

If you don’t ever come to grasp that concept then unfortunately, you’ll NEVER feel like you have enough.

5 Steps To Retire Early With Real Estate

#1 Start with your “why”

Much like Simon Sinek’s book, “Start With Why“, Carson also recommends that before anyone gets started down the path to real estate investing, that they too start with the “why” they’re wanting to go this route.

For me, it came after I realized that the only income coming into our household was “active” income. Concerns about future injuries and/or disabilities pushed me to start pursuing avenues for passive income.

As with any goal you set for yourself, without the proper motivation, attempting them could be setting yourself up for failure.

Carson says, “You’ve got to build your finances and your business around personal goals.”

#2 Identify your “Freedom” number

Most doctors have NO IDEA what it would take to free them from retiring early from their practice.

One of the questions I ask new members of the Passive Investors Circle is this, “Do you know your Freedom Number (financial independence number)?

Most don’t because they don’t budget. If you know what it costs to live on each month then guess what? You know your Freedom number.

This is nothing more than how much passive income it would take to replace your monthly household expenses. Some calculations recommend you add an extra 10% on top of that as a buffer.

Example

So for instance, if your household expenses equal $120,000 a year, then your number = $10,000 ($120,000/12 – $10,000).

If you feel better about the buffer then 10% added increases your number to $11,000.

In this situation, all you need to do is acquire enough assets to replace $11,000/month then you’re FREE to do as you please. Simple, right?

This is what Carson did to be able to retire at 36 to spend more time with his family, traveling and building his online real estate business.

#3 Know you’re starting point

You can’t get to where you want to go without first knowing where you’re starting from.

- Do you know your net worth?

- How much have you saved in both retirement and non-retirement accounts?

- How much debt do you have?

These are the types of questions you should be able to answer at any point in your career.

It doesn’t matter if you’re fresh out of training or a seasoned professional. Knowing where you are NOW is key to determining how much further you need to go and how much risk to take.

The BIGGER your savings, then the greater your opportunities for investing in real estate.

If you’re just getting started and don’t have much to show for it, don’t let that discourage you.

We all have to start somewhere. Just the fact that you’re reading this shows that you’re SERIOUS about your wealth.

#4 Active or passive investor?

Carson suggests the next step in the process is to decide what type of investor you’d like to be: Active or Passive

Some of the different types of active investing are:

- Fix and flips

- Buy and hold

- Airbnb

- House hack

- Live-in-Then-Rent Plan

- Live-In-Flip Plan

- Buy-Remodel-Refinance-Rent-Repeat (BRRRR) Plan

When I decided I wanted to get into real estate investing, I knew that I didn’t want a SECOND job. Being a landlord was out of the question.

This made it easy for me to pursue the different passive real estate investment options available.

You may be different.

It’s for this reason that Carson includes the stories of 25 different real estate investors in his book.

In each story, you’ll learn how each investor created their own personal real estate investing plan to fit their wants and needs to achieve their goals.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter#5 Get ‘er done!

In Carson’s book, he ends by stating that we need to “get started” which for us folks down here in Louisiana…we like to say, “Get ‘er done” instead!

Carson makes it a point that no plan works unless YOU work. There’s no such thing as a “get rich quick” scheme in real estate investing.

You have to put in the time and effort before you see things paying off.

Take this blog for instance. I started in back in 2018 and it took until late 2019 to see things REALLY start to take off.

Once you make up your mind that you want OPTIONS when it comes to treating patients on your own terms then put pen to paper, make a plan and take action.

Passive Investors Circle

Speaking of action, we can help. The reason I created this site is for YOU.

My goal for you to to build cash flow and get into the habit of focusing on wealth building.

If you want to learn more about how you can reach financial independence/ early retirement and work on your own terms, join the Free Passive Investors Circle today.