Real Estate Syndication Tax Benefits For Passive Investors

Real estate syndications have become an increasingly popular investment option for high-income earners seeking to branch outside the stock market seeking passive income. While the potential for generating multiple income streams is one of the primary reasons for investing in real estate syndication deals, an often overlooked benefit lies in the significant tax benefits these investments can offer passive investors.

I originally started with syndications after a wrist injury made me realize how fragile my dental income could be. But it didn’t take long to realize how beneficial the tax advantages were when I noticed that our quarterly distributions were tax-free (or tax-deferred).

And the reason this was happening was due to one of the core tax benefits associated with real estate syndications; something called depreciation. This allows passive investors (limited partners) to deduct a portion of the cost of a property that loses value over time, thus mitigating their tax burden.

Depreciation can be greatly beneficial when used with accelerated methods (which we’ll get into shortly). These allow for larger property value reductions (paper loss) in the early phase of the investment cycle.

In this article, we will discuss all of the fantastic real estate syndication tax benefits that the limited partners can take part of.

As a side note, I’m NOT a CPA or financial advisor. This information is for educational purposes only.

Key Takeaways

- Real estate syndications offer tax advantages, including depreciation, lower capital gains tax rates, passive loss carryovers, mortgage interest deductions, and bonus depreciation.

- Depreciation is a core tax benefit in a real estate syndicate.

- Long-term syndication investments benefit from lower capital gains tax rates compared to ordinary income tax rates.

- 1031 Exchanges allow investors to defer capital gains taxes by reinvesting the proceeds into another qualifying property.

- The cost segregation strategy enhances tax benefits by accelerating depreciation deductions, resulting in increased cash flow and reduced tax liability.

Overview of Real Estate Syndications

Real Estate Investments vs. Stock Market

Many of our Passive Investor Circle members seek real estate syndication investments to avoid putting all their eggs in one basket (i.e., the stock market).

These investments allow real estate investors to pool their resources together to acquire and manage commercial real estate assets.

By doing this, they can benefit from economies of scale and shared expertise.

Most of these investments are for accredited investors only.

What about REITs?

Unlike investing in a Real Estate Investment Trust (REIT), passive investors in syndications can benefit from direct ownership of tangible assets, which leads to numerous tax advantages.

One of the biggest differences between real estate investment trusts and syndications has to do with the income generated. Income from REITs is considered ordinary dividend income, which and may lead to a larger tax bill. On the other hand, syndication profits are sheltered by depreciation and taxed at a lower capital gains rate.

Related article: Investing In Real Estate vs Stocks – What Are The Risks?

Passive Investors’ Role in a Syndication

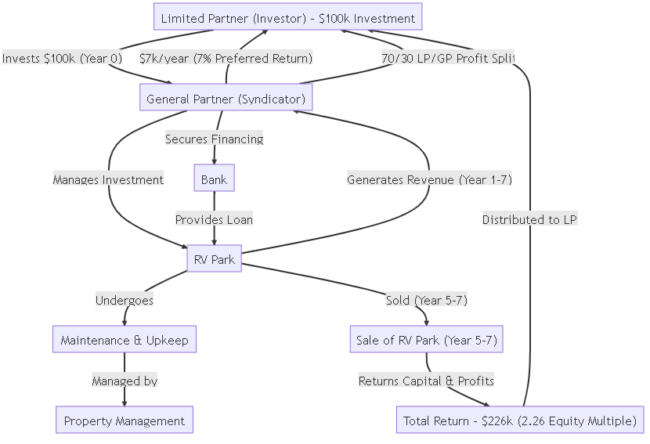

Passive investors (aka limited partner) are essential in real estate syndications. They provide the necessary capital for acquiring and managing income-producing property. By doing so, they can receive a share of the rental income and potential capital growth.

Passive investor benefits include:

- Diversification of their portfolio

- Exposure to potentially higher returns

- No managing of tenants (yes!)

- Limited liability

- Tax benefits

As with any investment, syndications also pose risks such as potential loss of investment, illiquidity, and reliance on the general partners’ expertise and management skills.

Responsibilities of General Partners

General partners (deal sponsors) in a real estate syndication have most of the responsibilities. They’re in charge of managing the operational aspects of the property, including:

- Identifying and acquiring properties

- Arranging financing

- Managing passive investors’ capital

- Overseeing property rehab and development

- Handling ongoing property management and maintenance

- Marketing to keep the property rented out

- Keeping potential investors updated on the progress

- Preparing for and executing the eventual sale of the property

The general partners’ performance directly impacts the overall success of the deal and the returns for all investors involved. The better they do, the more they’re compensated for their efforts resulting in a win-win situation.

Here’s an overview of a recent RV park syndication that we offered to our Passive Investors Circle members:

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterTax Benefits of Real Estate Syndications

#1. Depreciation Deductions

One of the largest tax benefits in real estate syndications is depreciation deductions. This allows passive investors to lower their taxable income by deducting the cost of properties losing value over time.

I realized this firsthand during my initial investments, as I didn’t have to pay taxes on any distributions during the hold period. However, you will have to pay taxes on the sales proceeds later.

Related article: How To Avoid Depreciation Recapture Tax On Rental Property

#2. Mortgage Interest Deductions

Another tax benefit for passive syndication investors is mortgage interest deductions. These help minimize the taxable income on the asset.

They may be applied to the interest paid on mortgages for various properties such as commercial and multifamily property.

#3. Passive Loss Carryovers

One of the most lucrative tax advantages in syndications is passive loss carryovers.

Limited partners can carry over passive losses that exceed passive income (distributions from the syndication) in a given year to future years. By doing this, they can offset any passive income earned during those subsequent years.

This advantage helps mitigate the investment’s initial losses and reduces the overall tax liability.

#4. Bonus Depreciation

Residential rental properties are depreciated over 27.5 years, and commercial property is 39 years. But real estate syndications benefit from bonus depreciation, allowing investors to accelerate the depreciation of the property in the first year.

This speeds up the ability to further decrease taxable income.

#5. Long-Term Capital Gains

Long-term capital gains play a crucial role in the tax benefits of real estate syndications. When an asset is sold after holding for at least one year, the resulting profit is classified as a long-term capital gain.

These are taxed lower than ordinary income, providing a significant advantage for real estate syndication investors.

Cost Segregation Strategy

Benefits of a Cost Segregation Study

Cost segregation is a powerful tool that allows real estate owners, including limited partners in syndications, to increase cash flow by accelerating depreciation schedules and deferring income taxes.

A cost segregation study identifies and reclassifies personal property assets to shorten the depreciation time for taxation purposes, which reduces current income tax obligations.

The primary goal is to identify all building costs that can be depreciated over a shorter tax life (typically 5, 7, and 15 years) than the building (39 years for commercial properties and 27.5 years for rental residential properties).

The accelerated depreciation deductions can significantly enhance the tax benefits of commercial real estate syndications by identifying and reclassifying these building components into shorter depreciable life categories. Some of the key benefits include:

- Maximizing depreciation deductions

- Reducing taxable income

- Deferring taxes on rental income

- Improving cash flow

To learn more about cost segregation, check out this video:

Impact on Cash Flow

One of the reasons I love investing in syndications has to do with the impact on cash flow a cost segregation study provides.

Taxable income decreases as the depreciation deductions increase, which ultimately leads to a reduction in the amount of taxes owed by limited partners. This translates to increased cash flow for the limited partners in the investment.

Cost Segregation Example

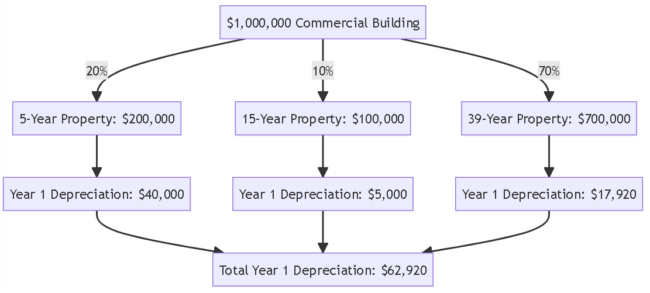

Let’s use an example to help illustrate how a cost segregation study might impact depreciation on a $1,000,000 commercial building.

Let’s say that the general partners of a syndication you’ve invested in performed a cost segregation study with the group I personally use.

They identified that 20% of the property cost could be allocated to 5-year property (personal property), 10% to 15-year property (land improvements), and the remaining 70% to 39-year property (non-residential real property).

Here’s how this would work:

-

5-Year Property: 20% of $1,000,000 equals $200,000. So, the depreciation for the 5-year property in year one would be 20% of $200,000, which equals $40,000.

-

15-Year Property: 10% of $1,000,000 equals $100,000. The depreciation for the 15-year property in the first year would be 5% of $100,000, which equals $5,000.

-

39-Year Property: 70% of $1,000,000 equals $700,000. The straight-line depreciation rate for 39-year property is approximately 2.56% per year. This means that the depreciation in the first year would be 2.56% of $700,000, which equals $17,920.

If you add those together, the total depreciation in the first year would be:

$40,000 (5-year) + $5,000 (15-year) + $17,920 (39-year) = $62,920

Here is the above information in an easy-to-understand diagram:

Join the Passive Investors CircleDo you want to lower your taxes and increase your cash flow? Schedule your cost segregation study HERE.

Tax Benefits Using Self-Directed IRAs

Traditional IRA vs. Self-Directed IRA

Most traditional IRAs (Individual Retirement Accounts) offer investment options in the stock market, such as stocks, bonds, and mutual funds. On the other hand, a self-directed IRA provides more diversification, including real estate syndications, precious metals, oil and gas, notes, private equity, and tax lien certificates.

With a self-directed IRA (SDIRA), individuals have more control over their investment decisions and can leverage the benefits of alternative investments like real estate syndications.

3 Benefits for SDIRA Real Estate Syndication Investors

Investing in real estate syndications through a self-directed IRA offers several benefits, including:

-

Diversification: Real estate investments can help diversify retirement portfolios, reducing the overall risk associated with traditional stocks, bonds, and mutual funds.

-

Passive Income: Syndications generate passive income through rental property income or property appreciation, which can grow tax-deferred within an SDIRA.

-

Tax advantages: SDIRAs provide potential tax benefits. For example, the earned income on the cash portion (down payment) in a real estate syndication can be counted as interest income. Using it for real estate investments can also defer taxes on investment gains.

Understanding that income from real estate purchased in part or wholly with debt financing is liable to Unrelated Debt-Financed Income (UDFI) taxes is crucial. Because of this, investors should consult with a tax professional about the tax consequences when using a self-directed IRA for real estate syndications.

Additional Tax Benefits

1031 Exchange

A 1031 exchange is a tax-deferred strategy that allows investors to defer paying capital gains taxes on selling a property until they buy a new one.

This primarily benefits limited partners in syndications, allowing them to defer the payment of capital gains taxes once the property is sold.

By utilizing a 1031 Exchange, investors can:

- Defer capital gains taxes

- Reinvest the full amount of their initial investment into a new property

- Reset depreciation

- Diversify their real estate portfolio

It’s important to be aware of the specific requirements for a 1031 Exchange including:

- Selling an investment property and buy a like-kind replacement property of the same or higher value.

- Within 45 days of selling, the investor must have up to three identified replacement properties.

- The investor has 180 days to buy one or more listed properties.

Opportunity Zones

An Opportunity Zone is an economically-distressed area in the United States where new investments, under certain conditions, may be eligible for preferential tax treatment. Congress created the Federal Opportunity Zone Program as part of the Tax Cuts and Jobs Act of 2017 to encourage long-term investments in low-income urban and rural communities nationwide.

There are more than 8,700 designated zones nationwide.

Investing in an Opportunity Zone can provide the following benefits:

- Capital gains tax deferral on investments made within the zone

- Reduction of capital gains taxes for investments held within the zone for varying lengths of time, such as a 5-year or 10-year holding period

- Exclusion of investment gains from capital gains taxes if the investment is held within the zone for at least 10 years

To take advantage of these tax incentives, property owners and investors must follow specific IRS guidelines, which include:

- Investing in a Qualified Opportunity Zone Fund (QOZF) is a vehicle for investing in eligible properties within the Opportunity Zone.

- The QOZF must be organized as a corporation or partnership and invest at least 90% of its assets in Qualified Opportunity Zone real estate projects.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterHow is Real Estate Syndication Income Taxed?

Commercial real estate generates income from the rent paid by the tenants. This income covers the costs necessary to maintain the property, such as:

- property taxes

- legal fees

- insurance

- maintenance

The difference between income and expenses is known as “Net Operating Income” or NOI.

If a property has a loan on it, which most do, then the required debt service is subtracted from NOI, resulting in the amount left to distribute to investors.

Once distributed to the limited partners, it’s combined with their regular income and taxed according to their ordinary tax bracket. This exact calculation can be complicated, and it varies for each individual. For this reason, working with a tax professional well-versed in real estate investing is always a good idea.

Conclusion

One commonly overlooked benefit of a real estate syndication investment is its ability to lower an individual’s tax burden.

Some of the most significant benefits include depreciation deductions, lower capital gains tax rates, mortgage interest deductions, and 1031 exchanges.

Due to the complexity in nature, it’s important to work with a qualfiied CPA to make sure everything is done correctly.