When I first started learning about passive real estate investing, one of the biggest obstacles to overcome were the new terms involved.

Some of the examples included:

Many times learning this new terminology is what initially keeps people away from investing in real estate.

I know it did for me.

But now that I’m more comfortable with it plus teaching others, it’s important to continually review each one as you review new investments.

One of the more important terms that legally has to accompany all private real estate deals is something called a private placement memorandum (PPM).

Yes, that’s a mouthful!

But in order for you to fully understand the significant amount of money that’s required to invest in these deals, it’s important to understand what a private placement memorandum is.

Before we dive in, let’s briefly review the types of deals we’re talking about…

The Basics of Real Estate Syndication Deals

If you’re new to passive investing, let’s start off with a quick review.

What’s a Real Estate Syndication?

A real estate syndication is when a group of investors pool their funds together in order to purchase a property that’s more expensive than they could afford on their own.

Many of our Passive Income Circle members are busy and don’t have time to research the hundreds of properties a year it takes to find one to invest in.

For this reason they choose to invest passively vs becoming an active investor (landlord).

Who’s Involved In a Syndication?

There are two basic groups involved in a real estate syndication:

- Sponsor (GP, operator) – They have a history of real estate experience and the ability to find, underwrite and perform due diligence with each property.

- Limited partners (LP) – Also known as the passive investors (you). They provide investment capital in exchange for a percentage stake in the deal/fund.

Sponsor Roles

The MOST important part of investing passively is finding the right sponsor you can trust.

Related article: 7 Best Ways To Evaluate a Real Estate Sponsor

Remember, it’s their job to “fly the plane” as they’re the ones doing all the heavy lifting.

Part of the process of putting deals together involve creating the legal paperwork necessary for passive investors (LPs) to review.

Whenever an issuing company raise capital for a private deal/fund, it’s called a “private placement.” In other words, it’s a private offering of equity in exchange for private investment capital.

This space is highly regulated by the Securities and Exchange Commission (SEC) which is mainly to protect you, the limited partners.

Some of the required paperwork address topics such as:

- deal structure (limited partnership or LLC)

- deal’s projected returns, capital structure (how and when money will be paid out)

- list of manager’s fees

One of the main documents that must be developed is the private placement memorandum which is all about full disclosure. In other words, it’s a disclosure document.

What is a Private Placement Memorandum (PPM)?

A private placement memorandum (PPM) is a legal document that lays out the details and disclosures of a private real estate offering (syndication). It discloses all of the important additional information an investor may want to know before agreeing to the terms in a private placement.

This document is similar to the prospectus public companies provide when issuing a public offering (i.e. mutual fund).

When investors are reviewing an investment opportunity, the contents of the PPM should include everything that’s needed in order to make an informed decision.

It’s for this reasons that they’re typically lengthy.

As a side note, before a deal is released to our Passive Investors Circle members, I’ll record a webinar with the sponsor going over the specific deal’s PPM.

When is a PPM Used?

Regarding real estate, when a sponsor group is selling securities for a private placement offering then a PPM is used.

Examples of private offerings are:

- Syndication

- Real Estate Investment Trust (private)

- Crowdfunding

- Real estate investment fund

What’s Included in a PPM?

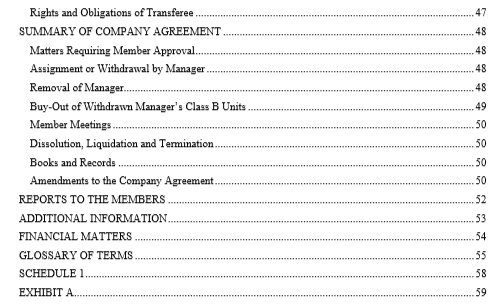

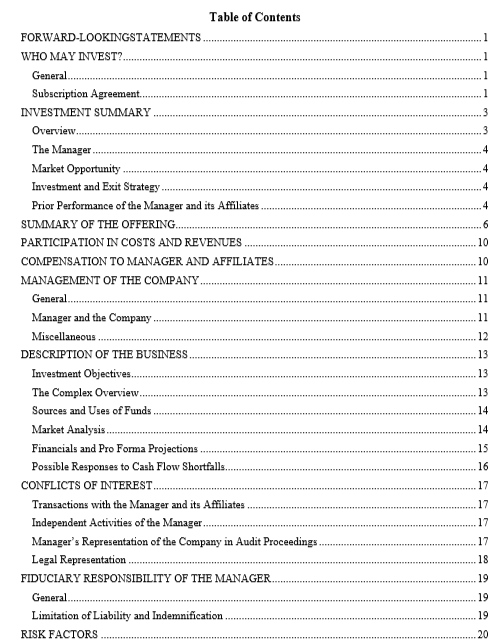

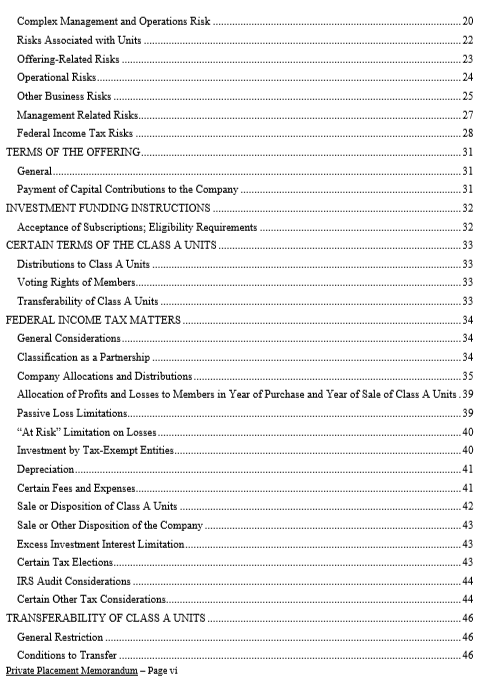

Here’s a sample from the contents of a PPM from a previous deal (Table of Contents):

In each syndication I’ve invested in, all of the documents from private placements have looked somewhat similar due to the specific information that’s required.

Here’s a break down of the key sections and what’s included:

Introduction

This is a brief statement about the company and outline of what it’s seeking in a private placement. This lets prospective investors know who and what they’re investing in.

Investment summary

This section provides more details and highlights regarding the property to invest in.

Risk factors

This section of the PPM provides the potential risks associated with investing in the particular deal. Oftentimes it’s the largest part of the entire document.

Risk examples include:

- tenant issues

- local market

- cybersecurity issues

- competition

- existing debts

Company information and management

Here you get to learn, in more detail, about the company you’re investing with such as:

- management biographies about each owner and team member

- company’s financial status

- track record (very important)

Who Can Invest

This details the certain type of investor that may participate in the project.

Most only allow an accredited investor.

Summary of Offering

This area of the document states exactly what the sponsors are asking for. It’s an overview of the terms of the offering such as:

- purchase price

- minimum investment

- number of shares being sold

- expected length of investment term

- expected rate of return

- how distributions will be handled

Conflicts of interest

This section explains any conflicts of interests with the investors. For example, one of the company’s manager could also be a real estate broker that earns a commission when the property closes.

Use of proceeds

This area explains the plan for the capital that’s to be collected from the investors. In other words, how the money will be spent.

Examples include:

- closing costs

- renovations to the property

- down payment

- any salaries or bonuses paid

Financial Information

As an investor, you want to make sure that you review this section as it may be one of the most important.

You’re entitled to know the financial information of the company that you’re possibly investing with including:

- historical financials

- expenses

- pro forma financials

- timeline to achieve profitability

- specific financial risks

Tax matters

This section informs investors the specific tax documents they can expect annually. All of the syndications I’ve invested in normally provides a K1 tax document.

It also provides other tax matters such as the depreciation expected.

Fees

If you’re curious as to what fees the sponsor charges, then this section will detail those such as:

- acquisition fees

- transaction fees

- loan fees

- asset management fees

- disposition fees

Liquidity and transferability

On occasion, investors may need to access their investment capital before the property is sold.

Most syndications are long-term investments and this area of the private placement memorandum will state if there are any type of redemption options and if the securities can be transferred at any point.

Timing and location of funds

Typically while the offering is still open to invest in, funds are collected and held in an account.

This section will disclose where the funds are to be held along with the timing of the offering and what will happen if the offering isn’t fully funded.

How to invest

How to invest and fund the offering is usually placed at the end of the PPM. It details how investors are to provide funds such as certified check, wire transfers, etc.

Join the Passive Investors Circle