Personal Capital vs Wealthfront – Which is best?

Personal Capital and Wealthfront are two of the more popular web-based investment management platforms. But choosing which to use is like anything else in the personal finance world, it all comes down to personal preference and need.

Each platform caters to a different segment of the investing community. Both have pros and cons and understanding those will be crucial in determining what’s best for you.

So let’s take a look at the comparison: Personal Capital vs Wealthfront

What Is Personal Capital?

Here is a brief overview of Personal Capital:

https://youtu.be/CctP6P-Xhok

Personal Capital is actually two services in one. On one side, there’s the part that services people that need free financial tools which we’ll get to shortly.

The other is for those that need a more personalized (fee-based) wealth management service.

Founded in 2009, Personal Capital has more than 2 million users utilizing their free financial tools. They’re a Registered Investment Adviser (RIA) with more than $9 Billion in assets under management (AUM). They also have over 19,000 investment clients throughout the U.S.

Free Financial Tools

For several years, we’ve been using Personal Capital’s free financial tools option. If you haven’t started using it yourself then you’re missing out.

Here’s a few things that it helps you do:

- track your spending (budget)

- track your net worth

- analyze your retirement portfolio

I personally think it’s one of the best free financial tools available.

Free Version Features

Investment Checkup tool – Analyzes your portfolio and recommends improvements to help you reach your goals.

Fee Analyzer – Helps improve long-term investment performance by identifying hidden investment fees and recommends alternative investments to cut those fees.

Retirement Planner – This feature helps you assess your retirement readiness. Using your actual financial data from the accounts you’ve linked to the Personal Capital Dashboard, you’ll see how prepared you are for retirement based on your ideal target retirement date.

It allows you to track your progress against your retirement goals, and make adjustments where needed. You can even calculate projected Social Security benefits, as well as pensions and rental income.

The Retirement Planner can even be used for non-retirement expenses, like saving for a down payment on a home or an upcoming wedding, or budgeting for your child’s college education.

Let’s move on to their dashboard…

Dashboard

Here’s a quick video overview of Personal Capital’s Dashboard:

https://youtu.be/tTQXOVA3Tkw

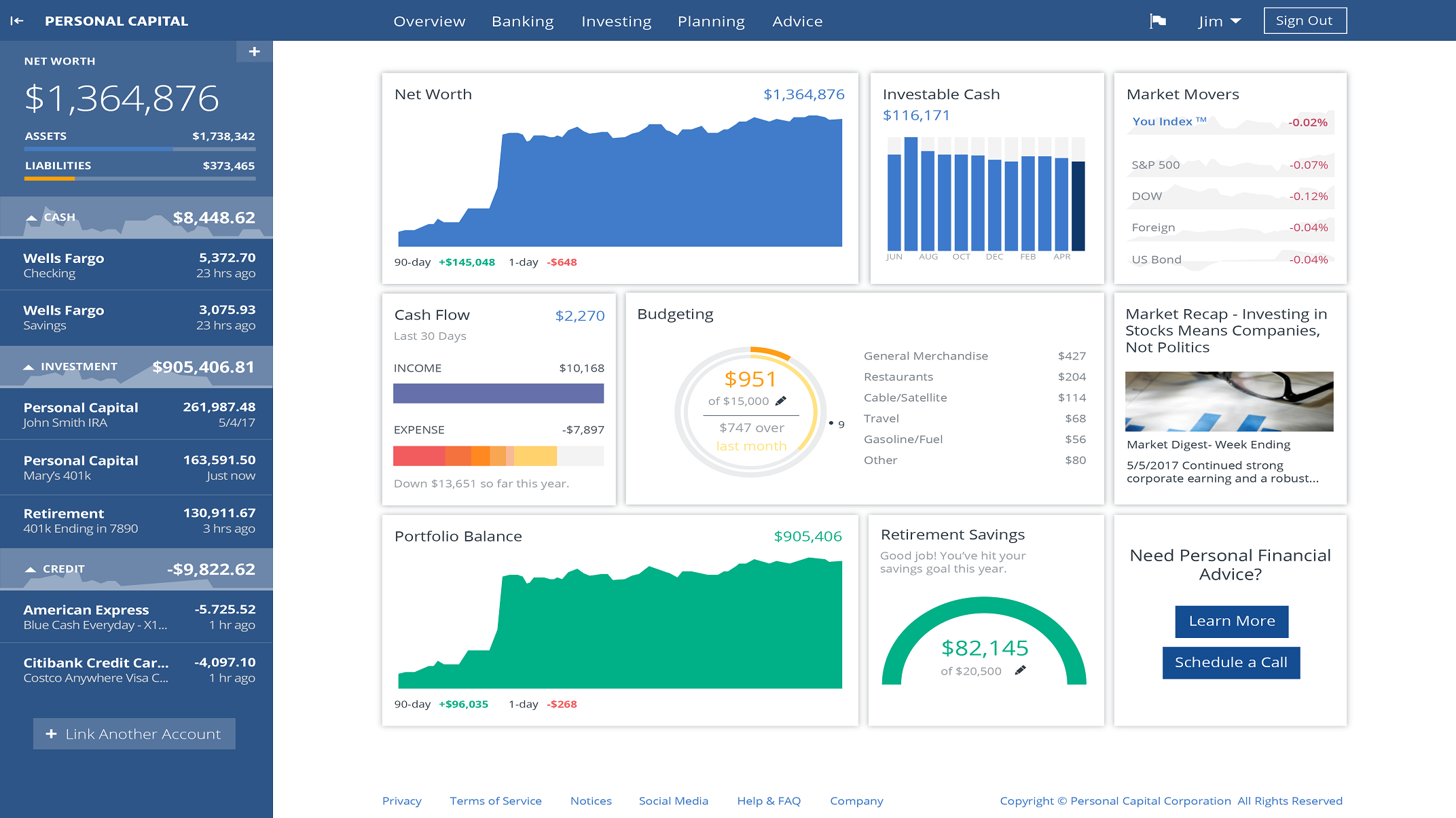

The Personal Capital dashboard provides a snapshot all of your financial accounts in one place, making it one of the most powerful features these tools offer.

Once you sign up, you simply link your financial accounts by filling in their online credentials (user name and password). It’s as easy as that.

This includes:

- bank accounts

- investments

- retirement accounts

- credit cards

- mortgages

- and other loans

Each day, your account information is automatically updated in real time and is presented via a colorful series of charts and graphs to allow you to better understand your financial situation.

Here’s an example of what you’ll see after logging in:

The Personal Capital online dashboard provides information about your:

- Income

- Expenses

- Budgeting

- Net Worth

- Asset Allocation

- Retirement Savings

- Investment Portfolio

I mainly use it to track the most important number in our financial picture– net worth.

Personal Capital fees

Personal Capital has a higher investable minimum of $100,000 compared to $500 for Wealthfront.

They have one simple fee based on a percentage of assets managed. Wealth management, trade costs and custody are included so you don’t pay extra for trade commissions.

Wealthfront also doesn’t charge trading fees.

Here’s their fee schedule:

| First $1 million: | 0.89% |

For clients who invest $1 million or more:

| First $3 million: | 0.79% |

| Next $2 million: | 0.69% |

| Next $5 million: | 0.59% |

| Over $10 million: | 0.49% |

Other Features

Individual account management. Each account under management is assigned a dedicated investment advisor, whether or not you use the wealth management service. This is an outstanding feature, given how low Personal Capital’s fees are compared to other investment advisory firms. You can have a free account review with a financial advisor to see if they add any value before signing up.

Investment management strategy. Much like Wealthfront, Personal Capital uses low-cost ETFs to create portfolio models. Similar to Wealthfront for taxable accounts, Personal Capital also uses a basket of at least 60 individual securities (for equities). The platform recognizes the investment value of minimizing fees and uses this investment methodology to keep them on the lower end of the investment scale.

Customer service. Personal Capital offers contact by phone or email 24 hours a day, seven days per week. They also offer a comprehensive FAQ page, which is focused mostly on Wealth Management. They also provide a Support Portal providing a large amount of information on the free financial software.

Let’s move on to Wealthfront…

What Is Wealthfront?

Here’s an overview of how Wealthfront works:

Wealthfront is an automated investment service firm based in California. It was founded in 2008 by Andy Rachleff and Dan Carroll. They have more than $13 billion of assets under management and pride themselves on having some of the lowest fees available.

Wealthfront Investment Methodology

Most refer to Wealthfront as a robo advisor. The service is built around Modern Portfolio Theory, or MPT, and your risk tolerance. This theory states the optimal mix of asset classes is more important than individual security selection.

Wealthfront accomplishes this through the use of exchange-traded funds (ETFs) focusing on a relatively narrow range of very broad investment classes.

The ETFs are centered on six asset classes:

- U.S. stocks

- Foreign stocks

- Emerging markets

- Real estate

- Natural resources

- Bonds

The use of ETFs enables an investor to hold as many as 10,000 underlying securities and to do so with extremely low fees.

Getting started with Wealthfront

After assessing the site, you start out by completing a short questionnaire used to determine your personal risk tolerance.

1. Answer Risk Tolerance Questionnaire

They make it easy by having you answer about ten questions that requires less than a minute to complete.

2. Receive Portfolio Recommendation

Next, Wealthfront recommends a portfolio and asks if you want to open an account. It’s that easy.

Account minimums

The minimum account size is $500. There is also a minimum withdrawal amount, which is $250, and you can’t draw your account below the $500 minimum.

Wealthfront fees

Wealthfront is set up to be extremely fee efficient. They make this possible by including the use of low-cost ETFs. Like many other wealth management systems, the fee structure is based on a sliding scale.

The first $10,000 in your account is managed free of charge — amounts in excess of $10,000 are charged an annual fee of 0.25%. Their site offers some of the lowest fees available to help manage your money.

Other Wealthfront Investment Features and Benefits

PassivePlus

PassivePlus® is Wealthfront’s suite of portfolio-enhancing features that deliver more value over buying and holding an index fund.

It includes the following features:

- Stock-level Tax-Loss Harvesting is designed to further reduce your tax bill by capturing losses on individual stocks within an index, not just the index itself. It activates when your account reaches $100k.

- Risk Parity aims to increase your risk-adjusted returns in a wide range of market environments through an enhanced asset allocation strategy. It activates when your account reaches $100K.

- Smart Beta is designed to increase your expected return by weighting the stocks in your portfolio more intelligently. It activates when your account reaches $500k.

College savings

Wealthfront offers 529 plans sponsored by the state of Nevada. The plan has a contribution limit up to $370,000 per child and has all-in fees (investment expenses and management fees) of no more than 0.46%.

Path (Digital financial planning)

Path is a tool that’s provided to Wealthfront clients for free. It’s a cool feature that helps to answer all of the “what ifs” life can throw your way regarding long-term planning.

Check out this video to learn more:

Cash Account

Whether you’re saving for a down payment on a home or funding an emergency fund, having cash is a must. Most savings accounts pay paltry interest rates but Wealthfront offers a savings account that pays over 2% interest.

Accounts available

Individual and joint taxable accounts; traditional, Roth, rollover, and SEP IRAs; trusts and 529 college savings plans.

Tailored Transfers

With Wealthfront, transfers will be accomplished gradually to minimize the tax implications, rather than immediate liquidation to cash. However, they will recommend you sell incompatible investments like mutual funds since they don’t fit within Wealthfront’s investment methodology.

Why You Might Prefer Wealthfront

With a low account minimum — $500 — Wealthfront is very well-suited to new and small investors.

It also offers much lower fees, 0.25% vs. 0.49% on the lowest tier compared to Personal Capital. Something else to consider is that it doesn’t have an annual fee for accounts of less than $10,000.

Another advantage to any investor, both large and small, is the hands-off nature of their investment management. Once your risk tolerance is determined, the platform creates your asset allocation mix, and you don’t need to do anything else.

It reminds me of the phrase, “set it and forget it.”

Sign up for Wealthfront if you want a low cost robo-advisor to manage your money via automation.

Why You Might Prefer Personal Capital

Like Wealthfront, Personal Capital also uses pre-determined investment allocations, like its own stock basket, as well as ETFs.

Personal Capital is also the better choice for investors with holdings beyond the platform itself. Personal Capital can give you a comprehensive portfolio view that accounts for assets held in your retirement portfolio and investment accounts not attached to the platform. They’ll automatically adjust your asset allocation to reflect these outside positions.

It’s also clear that while Wealthfront targets the small investor, Personal Capital aims for the middle-end investor who aspires to become a large investor. If you have significant holdings already, Personal Capital will be the choice in most cases.

Sign up for Personal Capital for its free award winning tools so you can analyze your investments and better plan for retirement. Only after you are comfortable with your finances do you want to consider getting hybrid financial advice.