[Editor’s Note: This guest post was submitted by physician financial blogger and Montana resident, David Graham, MD who blogs at FiPhysician.com. After discovering his passion for personal finance, he started a Registered Investment Advisory to promote his mission of “Financial Literacy for Physicians.” For personal enjoyment, he recently sat for and passed the CFP exam. Here’s The FI Physician’s look at should we pay off debt or invest.]

Should Doctors Pay Off Debt or Invest?

As a doctor, should you pay off debt or invest? That’s the million dollar question.

Debt payments and backdoor Roth contributions are made with after-tax money. When you pay off your debt, you guarantee a return on investment. Roth contributions, on the other hand, have investment risk, but grow tax-deferred and pay out tax-free.

Doctors start the savings game late, after years of training. Cash is gobbled up in the first few years of practice: student loans, a family, and mortgage payments all competing against investing for the future in a brokerage account—or even better—a backdoor Roth IRA.

Being a debt free doc is a nice feeling, but are there opportunity costs to consider when paying down debt?

Let’s look at a fictional doctor family who either pays off debt or invests in backdoor Roth IRAs to see how the numbers play out over a few decades.

Pay Off Debt or Invest Example

Dr. Debt Free and spouse, both 33 years old, have two young children. Together they make $250,000 a year, which will increase by an average of 1% a year. They have a 401k with a 6% contribution and 6% match.

In addition, they have a small brokerage account and have started backdoor Roth contributions. They invest aggressively in 90% total stock market index funds and 10% in bonds.

Let’s assume they make 6% on stocks, 3% on bonds, and inflation is 2%. They plan to spend $100,000 a year, and want to know what to do with the rest of their income.

Thinking about college needs, they plan to invest $5000 a year in 529 plans if there’s sufficient cash flow.

Table 1 (loans)

| Loans | APR | Minimum Payment | Loan Balance | Term |

| Car | 3% | 195 | 25,000 | 10y |

| Student | 5% | 1591 | 150,000 | 10y |

| Mortgage | 4.5% | 1968 | 400,000 | 30y |

They have a car loan, refinanced private student debt, and a zero-down physician home mortgage. Minimum monthly debt service is $3,754.

Debt Plan vs. Roth Plan

Let’s look at two different scenarios.

1) The first aggressively pays down debt with an extra $2000 a month above the minimum payments, or $24,000 extra a year. Let’s call this the Debt Plan.

2) Or, consider the Roth Plan. Here, they will put away $12,000 a year in backdoor Roth IRAs and the rest will be invested in the brokerage account and 529 plan. They pay minimum debt amounts monthly.

So, should they pay off debt or invest? Which plan do you pick to come out ahead?

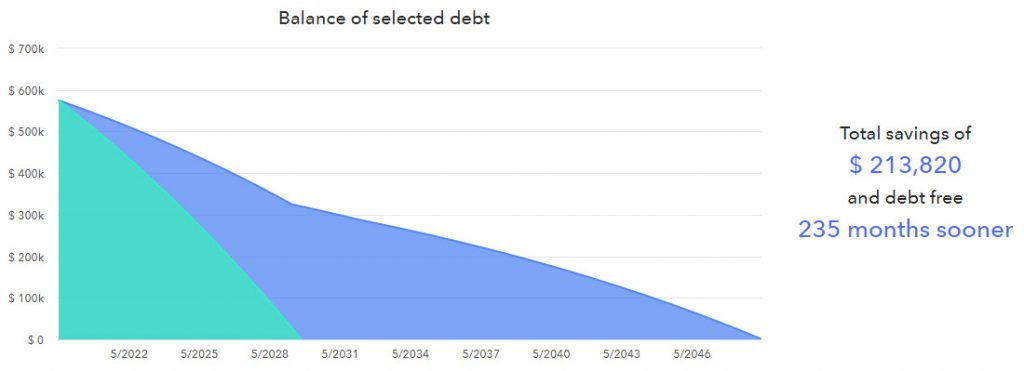

Balance of Debt

Figure 1 (balance of debt)

The figure above shows debt payment over time for the two plans. In the Roth Plan (dark blue), student and car loans are paid over 10 years, and the mortgage takes 30 years. The Debt Plan (teal) rapidly pays off all debts 19 years earlier, and saves almost $214,000 in interest payments over 30 years.

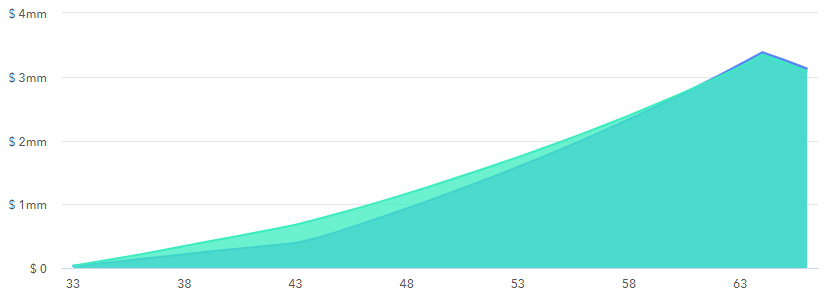

Invested Assets

Figure 2 (invested assets)

In figure 2, we can see the invested assets for the Roth Plan (light green) and for the Debt Plan (darker green). Clearly, you get a head start investing aggressively, but over 25 years the Debt Plan catches up.

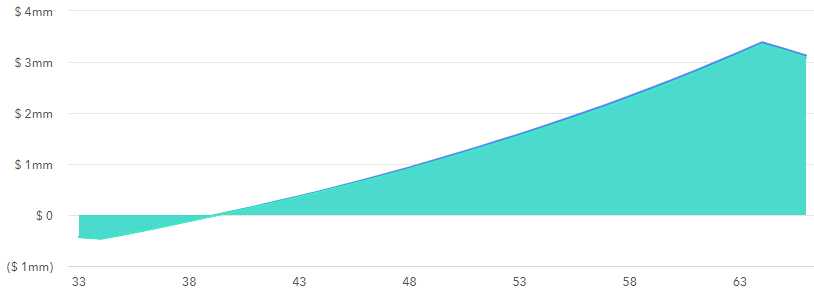

Net Worth

Figure 3 (net worth)

Net worth for both of the plans start off negative. Both plans reach zero at year six and they are millionaires after working for 15 years!

Breakdown of Cash flow

Let’s check out the cash flows for each plan in more detail. Every second year is shown for the first decade, and then every 5 years out to 30 years total. Cash flows are shown in thousands of dollars.

| Plan | Year | Debt payment | Brokerage | Roth | 529 | Net Worth |

| 2020 | 69 | 21 | 15 | 0 | -462 | |

| 2022 | 69 | 23 | 19 | 0 | -295 | |

| 2024 | 69 | 25 | 23 | 0 | -114 | |

| 2026 | 69 | 19 | 26 | 0 | 73 | |

| 2028 | 69 | 3 | 27 | 0 | 268 | |

| Debt | 2030 | 24 | 18 | 41 | 5 | 473 |

| 2035 | 0 | 235 | 113 | 37 | 1,057 | |

| 2040 | 0 | 454 | 200 | 77 | 1,727 | |

| 2045 | 0 | 673 | 304 | 126 | 2,496 | |

| 2050 | 0 | 893 | 427 | 186 | 3,386 | |

| 2020 | 45 | 31 | 24 | 5 | -462 | |

| 2022 | 45 | 51 | 51 | 16 | -297 | |

| 2024 | 45 | 71 | 79 | 27 | -119 | |

| 2026 | 45 | 83 | 109 | 39 | 64 | |

| 2028 | 45 | 89 | 142 | 48 | 253 | |

| Roth | 2030 | 26 | 111 | 177 | 61 | 456 |

| 2035 | 23 | 212 | 276 | 103 | 1,026 | |

| 2040 | 23 | 301 | 394 | 156 | 1,666 | |

| 2045 | 23 | 371 | 536 | 219 | 2,451 | |

| 2050 | 0 | 459 | 705 | 281 | 3,346 |

Table 2 (cash flows in thousands of dollars)

Debt payments are listed first. They are $69,000 a year for a decade in the Debt Plan. In the Roth Plan, debts are $45,000 for the first decade, and then $23,000 a year for the next 20 years.

The brokerage account is actually spent down initially in the Debt Plan, but rapidly recovers and overtakes the Roth Plan in the second and third decade of the plan.

The Roth account is underfunded while the Debt Plan pays off debt. It never has time to recover and is only 12.6% of the total net worth ($427,000) at 30 years in the Debt Plan, vs 21% ($705,000) in the Roth Plan.

The 529 plan also is unfunded in the early years of the Debt Plan.

Net worth for both plans is about the same at 10, 20 and 30 years.

Both plans have about $400,000 in the 401k after 10 years, $1,000,000 after 20 years, and $1.8M after 30 years (data not shown).

The Results Are In

So, how is it that the Roth Plan did not perform better than the Debt Plan when conventional wisdom suggests investment returns beat payment of debt?

Certainly, assumptions of interest rates on the fictional debts and 6% return on stocks affect the results, and different assumptions will generate different results.

However, remember the FIRE dictum that early on, savings rate matters more than investment return.

With the 401k match, and including servicing of debt, they have approximately a 50% savings rate. They can manage this impressive savings rate despite living expenses of $100,000 a year and $60,000 a year in taxes.

Over time, savings rate decreases to “only” 20% as salary inflation is 1% and general inflation is assumed to be 2%. This tremendously high savings rate overwhelms any difference between interest rates and return on investments.

Specifically, the higher returns when investing take decades to compound, and the rapid debt payoff affords the Debt Plan to get debt free while still investing.

If you have a high savings rate, initial investment returns don’t matter as much, and rapidly paying debt down is as good as investing. Of course, it is nice to have that extra Roth money, which is tax-free, so when considering after-tax net worth, there is an advantage to the Roth plan.

What Do Bloggers Do?

- Physician on Fire happily paid off his debts, though retrospectively he knows this decision was not in his favor.

- Debt Free Dr says being debt free is the ultimate luxury.

- Wall Street Physician suggests paying down debt before investing; Wealthy Accountant paid off his debts too.

- Investing Doc says it is not black and white.

- White Coat Investor takes a middle ground, suggesting paying off non-deductible debts greater than 5%.

- Physician Philosopher also takes a measured approach, suggesting you look at debt to income ratio before deciding.

So, What Will You Do?

Pay off debt or invest for the future? If you could predict the future, you would know the sequence of returns of the stock market, and invest when the market is down and pay debt off when it is high.

Short of having a crystal ball, a high savings rate allows you to do both and reach financial independence rapidly, free from debt and ready to take advantage of the magic of compounding interest.

David Graham, MD, is a practicing Infectious Disease physician and blogs at FiPhysician.com. After discovering his passion for personal finance, he started a Registered Investment Advisory to promote his mission of “Financial Literacy for Physicians.” For personal enjoyment, he recently sat for and passed the CFP exam.