Schedule K-1 Tax Form: What To Know As a Passive Investor

Tax advantages are one of the primary motivations for investing as a limited partner (LP) in real estate syndications. These benefits are passed on to the LPs through an IRS document called the Schedule K-1 tax form (Form 1065).

If you’re in a business partnership, this form must be submitted to the IRS. It provides information on the previous financial year’s profit, losses, and sharing.

I have to admit that I found it quite confusing when I received my first Schedule K-1 form years ago. Several of our new Passive Investor Circle members have expressed similar feelings.

In this article, we’ll clear up the confusion and guide you through everything you need to know about the IRS Schedule K-1 tax form regarding your annual tax return.

*I’m not a tax advisor, so do not take this as tax advice. This is for educational purposes only. Please contact your tax professional or tax preparer for your situation.

Rather watch the video?

Join the Passive Investors CircleA pass-through entity distributes any income directly to its owners, shareholders, or investors. Because of this structure, only these individual partners are taxed on the revenue, not the entity itself.

These types of entities are commonly used to avoid double taxation. Let me explain.

The IRS taxes individuals on their earnings (income tax) and businesses on their revenue (corporate tax). Business entities can avoid paying corporate tax if they are structured as pass-through entities. Why? These entities’ income is only from the investors, owners, or stockholders. In essence, earnings pass or “flow-through” to each individual along with the tax liability.

They pay taxes on business income as if it were personal income at their usual income rate. The owners can also deduct the company’s losses from their personal income.

Although pass-through entities are subject to the same tax laws as C corporations regarding inventory, accounting, depreciation, and other factors influencing profit measurement, they are taxed only once.

On the other hand, earnings generated via C corporations face double taxation: once at the corporate tax rate and then again when distributed as dividends to shareholders or when shareholders realize capital gains from retained earnings.

K1s and Real Estate Syndications

My favorite real estate investments are real estate syndications. If you’re not familiar with how these work, check out the video below:

These investments involve multiple investors (general and limited partners) pooling their resources to invest in a property.

The general partner (GP) or sponsor is responsible for managing the property, making decisions, and handling day-to-day operations.

The limited partners (LPs) or passive investors contribute capital but don’t actively participate in property management..

These investments are often structured as either:

- Limited Partnerships (LPs)

- Limited Liability Company (LLCs)

Both are considered pass-through entities for tax purposes.

Each passive investor is responsible for paying their share of tax obligations as the syndication partnership does not pay taxes.

The sponsors prepare each limited partner’s K1 tax form, which provides information on their share of the syndication’s income, losses, and other tax-related items, such as depreciation and deductions related to the property’s expenses.

This form is then filed on their personal United States income tax return (Form 1040).

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhen Should The Sponsor Issue K1s?

Suppose you are a limited partner in a syndication or other pass-through entity. In that case, the sponsor should issue K-1s no later than the 15th day of the third month following the end of the tax year.

For example, if the tax year ended on December 31, 2022, you should expect to receive your Schedule K-1 by March 15, 2023.

Preparing and filing the partnership return is a time-consuming process involving multiple experts to ensure the information is accurate and the partnership can benefit from all available deductions.

However, there are instances where the filing process can be pretty complicated, and a filing extension may be necessary, which could delay LPs from receiving their K-1s. If this is the case, stay in communication with the sponsor of the investment you’re invested in to stay up to date on the expected timelines for the K-1.

How To Read a K-1 (Form 1065)

All K-1s are divided into three parts:

- Part I: Partnership information

- Part II: Information about the partner or shareholder

- Part III: Partner’s of shareholder’s share of current year income, deductions, credits, and other items

Let’s break each section down one by one.

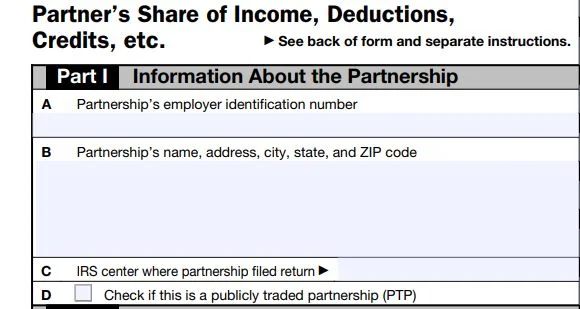

Part I

Here’s Part 1 of a blank K-1 form.

Contains information about the partnership, including:

- Employer Identification Number (EIN) number.

- Name and full address

- Number of shares (for corporations)

As previously mentioned, the sponsor completes and sends K-1s out to the limited partners.

Also, if you’re a limited partner, you don’t need to worry about filling out this form, as it’s the responsibility of the entity issuing it to you.

When you review this section, recognize the partner’s name and information to ensure they sent you the correct K-1 form for the right investment.

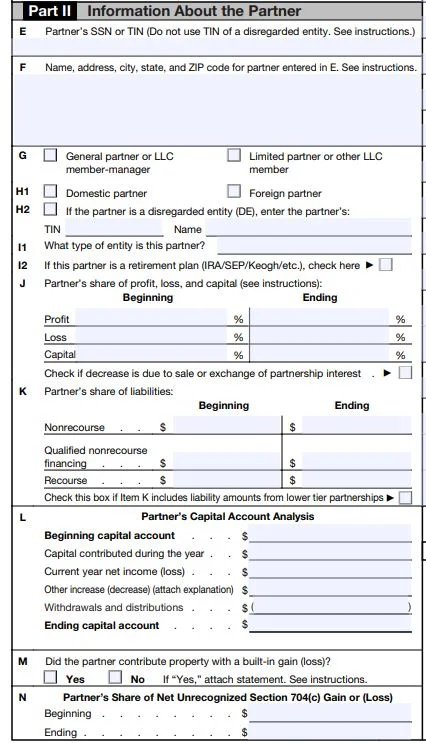

Part II

This section contains your information and involvement as the investor, including:

- SSN or TIN number

- name and full address

- number of shares and loans (for corporations)

- type of partner, losses, and shares (for partnerships)

It’s imperative that this information is accurate as you may have had a change of address.

Section G states the kind of partnership stake you have (general partner, limited partner, etc.) and Section J highlights what the profit and loss were for the year.

Part II also shows your:

- beginning balance

- any capital you put in

- increases leading to your ending balance

Once more, verify the information to ensure accuracy as you don’t want to be taxed on gains you didn’t receive.

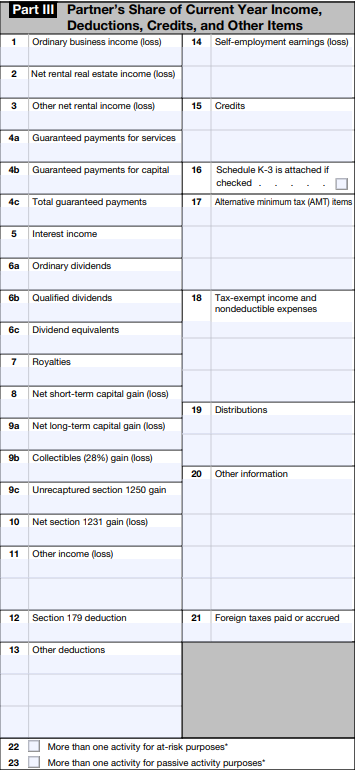

Part III

This section documents any income you received.

Box 2 states the net real estate income gain or loss, which represents the profit or loss made by the Limited Partner (LP) according to their percentage of ownership. This net amount is calculated by subtracting expenses from the revenue and incorporating any depreciation received from the property.

In most of the syndications I’ve invested in, there’s typically a “net rental real estate loss” as the depreciation from the cost segregation study is higher than the net income. In these situations, there can be a loss (negative number in Box 2) even though the LP received distributions during the year, which is reflected in Box 19.

Occasionally, new investors in syndications will see this negative number and worry that the asset has underperformed, resulting in a loss of capital. But this isn’t the case as this number reflects their share of the “paper loss” received from the depreciation.

The loss from the depreciation allows us, the limited partners, to lower our passive income taxable amount (distributions received from Box 19). This allows us to keep more from our investments.

FAQs

Do I need to report a K-1 on my taxes?

Yes, you need to report the information from a K1 on your individual returns, as it details your share of income, tax deductions, credits, and other items from a partnership, S corporation, or estate/trust.

Who needs to complete a K-1 form?

The partnership, S corporation, or estate/trust is responsible for preparing and issuing K1 forms to their partners, shareholders, or beneficiaries.

What’s the difference between form 1099s from a K1?

A 1099 is used to report different types of income, like interest, dividends, and freelance payments, that a person or small business has gotten. On the other hand, a K1 shows a partner’s, shareholder’s, or beneficiary’s share of income, deductions, credits, and other things from a partnership, S corporation, or estate/trust.

A 1099 is used to report various types of income received by an individual or entity, such as interest income, dividends, or freelance payments. A K1, on the other hand, reports a partner’s, shareholder’s, or beneficiary’s share of income, deductions, credits, and other items from a partnership, S corporation, or estate/trust.

How is K-1 income taxed?

K1 income is typically taxed at the individual’s ordinary income tax rate. However, the specific tax treatment can vary depending on the type of income, deductions, credits, or other items reported on the K1.

As mentioned, the K-1 will reflect your net rental income in Part III in Box 2. Typically this amount is subject to a lower tax rate due to the deprecation deductions. If you have a positive K-1 amount, you’ll pay your marginal tax rate on that revenue. If it shows a loss, then no taxes will be owed. How about that?

What happens if I don’t file my schedule K-1 forms?

Suppose you neglect to file a K-1 form along with your personal tax returns. In that case, it can lead to penalties and a potential IRS audit due to underreporting your taxable income.

Summary

If you plan on investing as a limited partner in syndications, understanding how to read and use a K-form is crucial as it states your share of the partnership’s income, losses, deductions, and credits.

Refer back to this article each year once you receive your K-1.

Join the Passive Investors Circle