For the past decade, the average inflation rate has hovered around the 2% mark for the United States. Many of the “financial experts” are forecasting higher inflation than normal due to the 2020 pandemic.

They state this is from a rise in unemployment rates, higher costs of goods, failing businesses and large injections of stimulus money from the federal government.

Whether this increase in inflation impacts the U.S. is yet to be seen. But for those of us that are focusing on real assets, it’s smart to get educated regarding:

- how inflation works (with real estate)

- best inflation hedge to invest in

- how rising inflation can can impact your assets and/or debt

Let’s answer these questions to find out if real estate investing is the ideal inflation protection for your portfolio.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhat Is Inflation?

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” – Ronald Reagan

Inflation is when price increases occur and the purchasing power of a currency drops. It means that you can buy less goods and services with your money than you used to be able to.

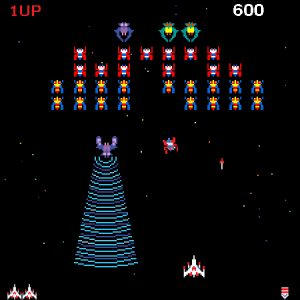

For instance, I can still recall the day I wanted to play Galaga (one of my favorite arcade games) in an airport while traveling to Colorado.

I couldn’t believe the cost to play had doubled from a quarter to fifty cents!

With inflation, your dollar’s purchasing power diminishes over time.

For example, in the mid-90’s what you could buy with $1,000 would now cost around $1,700.

That’s a 65% cumulative rate of inflation over 24 years.

Let’s use another (larger) example. If you bought a house in the mid-90’s for $250,000, today you would need around $420,000 to buy that same house.

Remember, this doesn’t take into consideration any of the home’s appreciation along the way. It’s only accounting for the spending power and value of the dollar changed due to the inflationary period.

At some point, all economies experience inflation increases (and deflation).

This isn’t so bad until when income levels of a population don’t track with or exceed inflation.

In that case people become poorer, even if they think they are making more money.

What Causes Inflation?

Most of us relate inflation to the concept of supply and demand.

Typically a rising demand for goods can cause the supply to go down, thus higher prices. (Remember the toilet paper shortage during the pandemic?)

We saw this locally in Louisiana during the first half of 2021 with housing costs.

It was out of control as it seemed that the increased stimulus money caused people to want to go and buy a house.

This is another example of supply and demand as the number of people wanting to buy a home was larger than the number of homes on the market.

This caused home prices to get to a point that I’d never seen in my hometown in Northeast Louisiana.

This is an example of what economists refer to as “demand-pull inflation” when demand outpaces supply.

There’s also something else called “cost-push inflation“.

This occurs when prices of goods go up due to a higher rate in the cost of wages and raw materials. The high cost of production can decrease the amount of total production in the economy. Because demand for goods hasn’t changed, the increased prices from production are passed onto consumers.

My dad recently told me the company he purchases hot water tanks from is raising prices by 30% next month. This is an example of cost-push inflation as there hasn’t been an increase in demand but the cost to manufacture them has skyrocketed. Unfortunately, this will have to passed on to his customers.

Rich Dad Poor Dad author Robert Kiyosaki states that another way inflation can happen is when the government manipulates a money supply such as when the U.S. uses quantitative easing.

He claims that injecting more money into the financial system allows the central banks to issue more debt, which causes prices to increase.

How Inflation Erodes Your Retirement Savings

Many people approach retirement by attempting to accumulate enough to maintain their current lifestyle and income.

If you’re used to making $100,000 a year, then your financial advisor would more than likely set you up in investments based on keeping up your current $100K lifestyle.

But what if you’re not going to retire for 30 years and started investing back in the early 90’s with a $100,000 salary?

Fast forward 30 years later (to today). Now you’d need investments providing $210,000 a year due to the cumulative inflation rate of 109% over the past 30 years.

They also don’t take into consideration all of the fees that was charged along the way to manage the accounts which also erodes the funds required to keep up with the inflation rate.

This continued increase in prices wouldn’t be as bad if the purchasing power of a dollar rose alongside it. Except we know that’s NOT the case.

Americans must attempt to make more money to battle inflation. Unfortunately, wages have been stagnant for decades.

Who Controls Inflation?

In the U.S., the Federal Reserve, like other central banks, controls inflation. One of their responsibilities is to keep prices from rising or falling too quickly (pricing stability).

They note that an average rate of inflation should be 2% each year as the right amount. They get this figure based on the consumer price index.

The federal funds rate is the primary tool the Fed uses to conduct monetary policy by the rate banks pay for overnight borrowing in the federal funds market.

Changes in this rate influence other interest rates which in turn influence borrowing costs for households and businesses.

When inflation is too high, the Fed typically raises interest rates to slow the economy and bring inflation down. On the other hand, when it gets too low, they typically lower rates to stimulate the economy and move inflation higher.

Once inflation drops, it usually makes a stronger demand for goods and services which can push wages and other costs higher, influencing inflation.

In a nutshell, inflation is a never-ending up and down cycle.

Inflation And Real Estate – What You Should Know

Don’t take it from me. More millionaires invest in real estate and use it as an inflation tool and to produce cash flow in retirement than any other asset.

Real estate investments hedge inflation as their value typically is expected to go up in value over time.

There’s 3 main ways that makes real estate a great inflation hedge:

#1 Appreciation offsets inflation

In the real estate market, the term appreciation refers to the increase in property values over time. For the home buyer, this is due to inflation, increased job growth and overall development in the town you live in. Many times you’re able to raise the appreciation value with home improvements.

For the investor in assets such as an apartment complex, appreciation can be “forced” by updating the property.

This allows the monthly rents to be raised which can be seen as a larger profit once the unit eventually is sold.

#2 Rental income increase

For example, if you have a 10 unit rental property that generates $10,000 in rent per month ($1,000 per unit), and increased each unit $100/ month, it would give you an extra:

- $1,000 per month

- $12,000 per year

- $120,000 in ten years

Not a bad return.

#3 Depreciation debt

Just as real estate appreciates in value, the debt owed is also depreciating in value due to inflation.

Let’s use a primary residence as an example with a $750/month mortgage. Within 10 years, the mortgage debt will be worth LESS due to inflation.

For our example, we’ll use the inflation range for the ten-year period from 2009-2019. That $750/month mortgage will only be worth about $640 due to inflation.

When you use leverage (financing), you’re able to take advantage of depreciating debt. Even though the mortgage will stay at $750/month each year, the value of that payment will be less as time marches on.

Related video:

How To Profit From Inflation

If you want to learn how to profit from inflation, look no further than the wealthy. They focus on leverage and hedging.

They understand that you can get a fixed rate loan, buy a cash flowing asset that makes the debt payment, and use little to none of their own money. By doing this, it also increases the return on investment.

Think about this scenario in an inflationary environment. Because the debt payment is fixed, it becomes less of a cost as the dollar loses purchasing power. In return, your investments and income continues to grow due to investing in assets that hedge against inflation.

As we discussed earlier, if you invest in real estate, the debt payment stays the same while rents go up due to inflation. This creates MORE cash flow for you even though your debt payment stays constant.

The same thing happens regarding businesses. As the cost of goods rise for the consumer, businesses can turn around and adjust their prices thus benefiting from inflation.

Why does this work?

It works because business owners and investors aren’t selling time.

Related article: The Importance of Time Value of Money

Business owners and investors are in control as they selling products and investing in assets that hedges against inflation.

On the other hand, employees are NOT in control of their product – (TIME), nor are they in control of their money (the bank or mutual fund is).

Bottom Line

Now you understand that there are multiple reasons why real estate can provide a reliable hedge against inflation.

One of the main reasons I personally invest in commercial real estate, such as passive syndications, is due to cash flow which serves well in an inflationary economy.

Join the Passive Investors Circle