“We’re DEBT-FREE!!”

After racking up $300K of student loan debt (dental school), I became a Dave Ramsey disciple hoping one day to be able to call his radio show and give our debt-free scream.

I thought his way was the ONLY way to building wealth.

Heck, he even starts each radio show with, “…where debt is dumb, cash is king and the paid-off mortgage replaces the BMW in the driveway as the status symbol of choice.“

Dave teaches one way and one way only, ALL debt is BAD.

But is it?

When you grow up learning that something is BAD (i.e. alcohol) from your parents/teachers, then no matter what others say, you think it’s bad, right?

Dave instructs us to focus on paying off all of our personal debt and once that happens, stay out of debt for the rest of our lives.

He’s best know for his get out of debt strategies (7 Baby Steps) to financial peace and has made millions off teaching this concept.

- Step 1: $1,000 in an emergency fund.

- Step 2: Pay off all debt except the house utilizing the debt snowball.

- Step 3: Three to six months of savings in a fully funded emergency fund.

- Step 4: Invest 15% of your household income into Roth IRAs and pre-tax retirement plans.

- Step 5: Fund college (i.e. 529 plan)

- Step 6: Pay off your home early.

- Step 7: Build wealth and give.

It’s helped thousands of people (including our family), but is it the ONLY way to financial success?

For those who follow this advice, debt becomes is a four letter word. We’re taught that the only way to live is being debt free and that we should cut up our credit cards.

I now understand that for some people, this is GREAT advice. If you can’t control your spending then it’s be a good idea to getting rid of the “Master” card makes sense.

Similar to a past alcoholic that can’t control his drinking….stay out of bars.

But there are others (like myself) that CAN control their spending and know how hard (inconvenient) it is today to try to live without a credit card.

For instance, it would be difficult to:

- book a flight

- check into a hotel

- rent a car

- shop online

- go out to dinner

But the more I’ve learned about money and debt, I realized that there’s actually good debt and bad debt.

Good vs Bad Debt

Defining what is good vs bad debt is simple.

Here’s the difference between the two…

Bad Debt

Bad debt typically can be thought of as debt that take money OUT of your pocket such as:

- student loans

- credit card debt

- car loans

Regarding student loan debt, this type of debt is questionable to me whether or not it’s bad debt as it depends on the situation.

For example, if someone takes out student loans and has no direct career path and wanders aimlessly through seven years of college (never graduating) changing majors like their socks then this would be categorized as bad debt.

But if someone needs these loans to pay for medical school, and plan on not going overboard (only taking out the bare minimum needed to get by), then this could be considered good debt.

Most of the poor and middle class spend their entire lives working to pay off bad debt to cover their liabilities (flat screen TVs, car loan, boats, etc.).

I’ve also learned that the way the rich use debt and the way the poor and middle classes use debt are vastly different.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterGood Debt

Good debt is debt that puts money in your pocket by allowing you to buy assets that will increase in value and/or pay you income. In other words, it’s used to give you a stronger financial future.

An example would be taking out a loan for an investment property that you rent out.

This would be considered good debt as long as the asset’s cash flow covers the debt payment and puts money in your pocket.

The rich use this kind of debt to buy assets or create products as they know that debt is essential to the American economy.

As without debt, our economy would collapse as it’s based on inflation (which is encouraged through debt).

Is Your Debt Destructive or Constructive?

“A bank is a place that will lend you money if you can prove you don’t need it!” – Bob Hope

One of the reasons I started this blog in the first place was to educate. I’m NOT perfect by any means but as I continue to learn what would be best for you, I pass it along…free of charge :).

When you’re scratching your head trying to figure out if taking out a loan would be good or bad, here’s 3 popular approaches that can help you know the difference.

#1 Debt instead of discipline.

As we discussed earlier, debt can be destructive when it’s used because planning and self-discipline were NOT.

If you think that credit cards possess the MAGICAL capacity to create wealth due to point accumulation, then it maybe time to cut them up.

#2 Debt instead of delay.

If we follow some of the financial gurus way of thinking regarding NEVER taking out debt, then we’d never own a home.

Sometimes you have to weigh out is it worth renting for 10-15 years while saving for a home versus losing time spent building memories with your family in a home that you own.

Constructive use of debt allows this especially when lenders are “selling money” at all time lows.

#3 Debt instead of diversion.

How many wealthy people do you know that have enough assets to pay off their mortgages? I’m sure they understand that by doing this, they’d become debt-free but instead they choose NOT to.

Why is this?

It’s because they know that they could use the extra money to invest into businesses and real estate that could continue to grow their net worth.

They understand that keeping some debt so they can invest instead – debt instead of diversion, can be their best choice.

Debt is nothing more a magnifying tool. It makes bad financial decisions WORSE and good financial decisions BETTER.

Rich Dad – Financial Intelligence

Here’s what Rich Dad Poor Dad author, Robert Kiyosaki, has to say about debt.

He doesn’t care if you have mortgage on your house or not, he feels that a house is a liability.

He knows that the rich buy assets. The poor and middle class acquire liabilities that they THINK are assets.

His reason starts with knowing the 6 words that are the basics of financial intelligence:

- Income

- Expense

- Asset

- Liability

- Cash flow

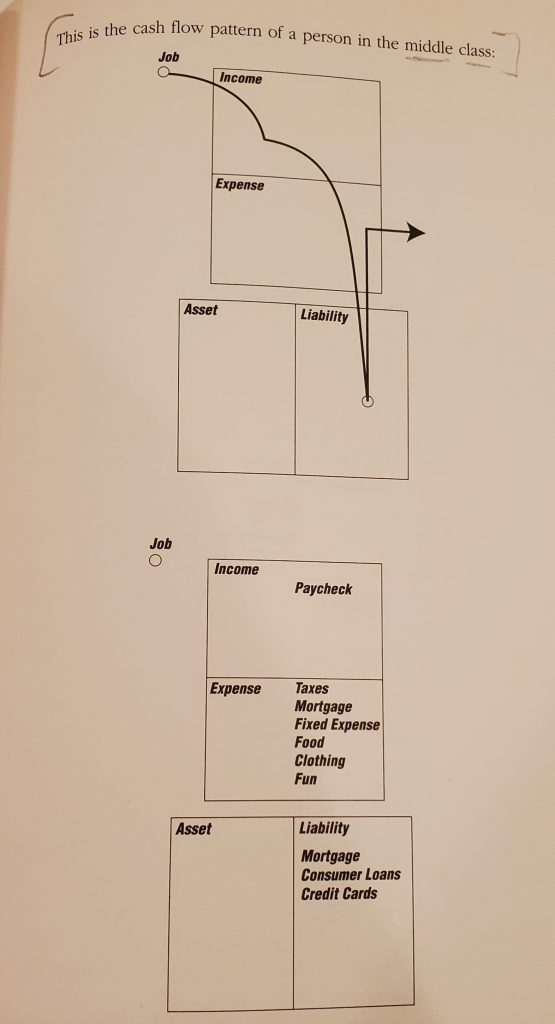

Take a look at his diagram below showing the cash flow pattern of the poor and middle class.

So when you look at the average person, they have a job. Money comes in at the top and it pays for their house and the money goes to a bank for a mortgage.

He teaches that a house is not an asset but a liability because the cash is flowing out. It goes to paying expenses, taxes, repairs, insurance, upkeep, etc.

Same thing with a car. Money comes in, and then it goes out to pay for the expenses that the liability (car) creates.

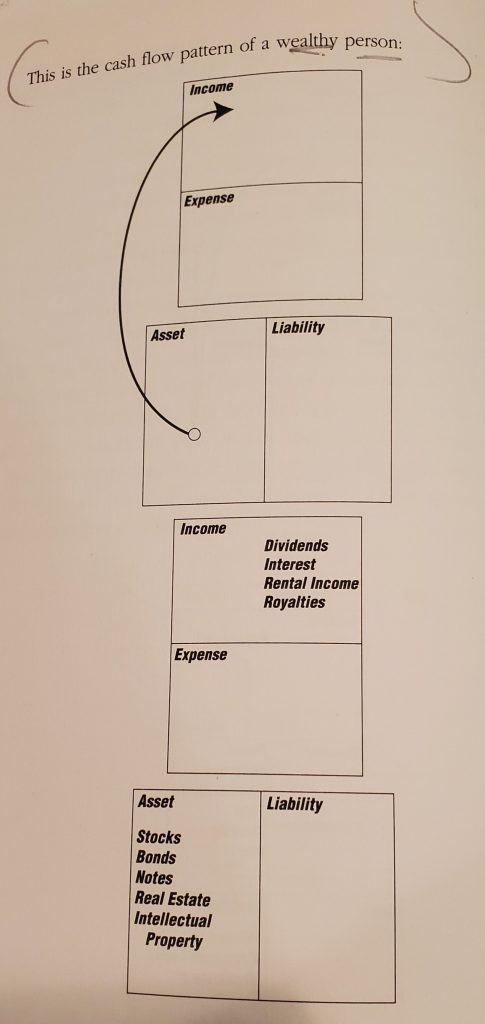

Now let’s take a look at the cash flow pattern of a rich person. The assets (real estate, stocks, etc.) create income which goes right back into the person’s pocket.

Kiyosaki’s big lesson for you is that it really doesn’t matter what type of asset the debt is on.

It could be a car or house. If the car is being used by an Uber driver and someone is renting your house then it’s all about where the cash is ultimately flowing.

If the cash is flowing into your income statement or into your pocket, then it’s an asset. It’s good debt.

But if it’s taking money from your pocket, it’s bad debt.

Cash Flow

If you’re going to be successful, whether you’re an employee or entrepreneur, you’ve got to control the direction of your cash flow.

Most people go out and get a job and the cash flows out to expenses that liabilities create. It goes to the government, called taxes.

Successful people don’t operate like this. It’s the reason that they’re entrepreneurs and not employees.

Bottom Line – Get Out of Bad Debt And Get Into Good Debt

When in doubt whether or not to use debt, here’s a good rule of thumb: “Never use debt to acquire a depreciating asset.”

A depreciating asset is something that won’t gain monetary value over time. The chances of later getting back what you paid for it are slim to none (think new car).

Remember that bad debt can make you poor as it’s used to buy liabilities.

Good debt is debt that can make you wealthy if it’s used for the right reasons such for investment property or to purchase equipment for your business that will make you a return.

This is the type of debt that’s used to buy assets.

Real estate example ($100K)

With real estate, you’re able to leverage money with debt.

Using simple math, let’s assume you want to use $100,000 to invest in rental property.

You could take Dave’s advice and use the entire $100K and pay cash for only one property or use good debt to buy five $100,000 properties.

The bank would lend you $80,000 for each property and then you could divide your $100,000 into five $20,000 down payments.

Assuming a 5% interest rate, each loan payment would be around $500, including taxes and insurance.

In this scenario: cash flow on each property would be $300 a month ($800 in rent – $500 in debt payment = $300 per month)

For all 5 rentals it would look like this: $1,500 ($300 x 5 = $1,500) per month

This investment would give you a 18% annual return which is twice as much as if you had only used your own money.

You can research other articles or YouTube videos on specific ways you can use debt to build wealth.

What you’ll find are references to using margin investing, leveraged ETFs, hedge funds, and short selling.

But no matter how you want to use debt to build wealth, it all starts with educating yourself about the difference between good and bad debt then making a mindset shift to using good debt to your advantage.

Join the Passive Investors Circle