How to Get Out of the Rat Race: A Doctor’s Guide

Escaping the rat race often feels like a distant dream. But it’s more attainable than you might think.

I’d never heard of the term “rat race” before until a few years of practicing dentistry.

It’s a way of life where you’re caught in a seemingly never-ending work cycle.

For me, it was getting up each morning, treating patients to pay bills, and striving for a financial reprieve that I felt would never come.

What about you?

Are you craving a great escape, a life where your time is your own, and your efforts afford you a living and a fulfilling lifestyle?

Once I began studying what to do about my situation, I realized that extracting myself from this cycle is less about luck and more about deliberate, strategic planning.

And that’s what we’re going to discuss in this article….

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhat is the Rat Race?

The term ‘rat race‘ is commonly used to describe a frustrating, hard-to-break cycle of work that leaves little time for relaxation or enjoyment.

It’s a never-ending cycle of work where you find yourself caught up in a pursuit of financial stability or social status, often at the expense of a simple life and personal fulfillment.

“The things you own end up OWNING you.” – Tyler Durden

This cycle is characterized by:

- Long working hours: Stretching your workdays into nights with minimal rest.

- Living paycheck to paycheck: Earning just enough to cover your monthly obligations without saving much.

- Constant sense of competition: Feeling the need to keep up or outdo peers in wealth and possessions, a.k.a; the status game.

Rather watch the video instead?

Here you go:

The Psychology Behind the Hamster Wheel

By nature, humans seek progress, but when your every day becomes a repeat of the last in a chase for status gain, you are said to be on a ‘hamster wheel.’

Key psychological aspects include:

| Factor | Description |

|---|---|

| Desire for Approval | The need for societal validation that encourages continuation in the cycle. |

| Fear of Missing Out (FOMO) | Observing others’ achievements on social platforms, fueling the desire to keep up. |

| Habitual Routines | Daily life becomes a series of hard-to-break habits, reinforcing the cycle. |

Where I First Learned About The Rat Race

I was initially introduced to the Rat Race concept after reading Robert Kiyosaki’s Rich Dad Poor Dad.

He defines it as the vicious cycle we learn from a young age that the only way to get ahead is to go to a good school, get a job, and work harder to try and get ahead.

He states that the Rat Race game is a losing one.

He reasons that it makes you entirely dependent on other people, which includes your:

- parents

- teachers

- boss

This dependency completely shuts off your mind from other possibilities and ways of functioning and thriving in today’s world.

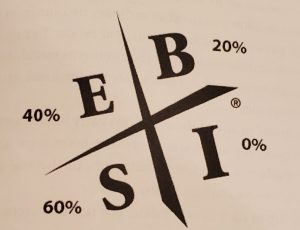

In Rich Dad’s Cashflow Quadrant, he also teaches that those on the left side (E – employees and S – self-employed) are stuck in the rat race.

If they don’t work, no income comes in.

He states the easiest thing to do is invest in assets that will provide financial freedom using active income.

This is how successful people operate.

Want to learn more about the Cashflow Quadrant?

Check out this video:

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterPreparation and Mindset

Assessing Your Current Position

One of the first steps of “exiting” the rate race is to look at your starting point.

Evaluate your current position by looking hard at your financial status and life choices. Begin by listing your:

- Income sources: Identify all your streams of revenue.

- Monthly expenses: Itemize your spending to understand basic needs versus wants.

- Debts: Summarize outstanding debts, including interest rates and due dates.

- Savings: Tally up your emergency fund and any investments.

This assessment will give you a concrete idea of what resources you have and what it will take to achieve financial independence.

Use a simple table (like the one below) to visualize your financial landscape:

| Category | Details |

|---|---|

| Income | $X (after tax) |

| Monthly Expenses | $Y |

| Debts | $Z |

| Savings | $W |

Analyzing this data allows you to see if your expenses are outpacing your income—a key factor keeping many within the rat race cycle.

Embracing Lifestyle Changes

Embracing lifestyle changes is vital for escaping the pressures of a paycheck-to-paycheck existence. Focus on simplifying your life to ensure your spending does not exceed your basic needs.

Consider the following strategies:

Prioritize expenses

Cut unnecessary costs that don’t contribute to your overall happiness or goals.

Downsize

Moving to a more modest home could free up significant funds if your living situation is more luxurious than necessary.

Frugality

Adopt frugal habits that enhance your personal life without inflating your expenses.

Remember, escaping the rat race isn’t just about the numbers; it’s also about reshaping your real life to align with your true priorities.

Financial Planning

#1. Setting Financial Goals

To achieve financial success, begin by setting specific, measurable financial goals. Know what you want to accomplish, whether it’s attaining a certain net worth, generating passive income streams, or saving for retirement.

Start by writing down your long-term goals and then break them down into medium and short-term targets.

#2. Creating a Budget

A detailed budget is vital for tracking where your money goes each month.

List your income sources and expenses to find the surplus for savings or investments.

Use the following table to help organize your budget:

| Category | Monthly Income/Savings | Monthly Expenses |

|---|---|---|

| Job Income | $ | |

| Side Income | $ | |

| Savings | $ | |

| Housing | $ | |

| Utilities | $ | |

| Groceries | $ | |

| Transport | $ | |

| Debt | $ |

Make adjustments to ensure you’re not living paycheck to paycheck and are redirecting funds effectively toward your goals.

#3. Eliminating Debt

High-interest debt, such as credit card debt or student loans, can hinder your financial freedom.

Prioritize paying off these debts first. For credit card debt, consider the snowball method (paying off small debts first for psychological wins) or the avalanche method (paying off high-interest debts first to save on interest).

#4. Building an Emergency Fund

An emergency fund is a safety net that ensures you can access enough money in your bank account for unforeseen expenses.

Aim to save three to six months’ worth of living expenses. This financial buffer can prevent you from falling further into debt when unexpected costs arise.

Join the Passive Investors CircleIncome Strategies

You must establish income sources beyond your primary job to achieve financial independence and escape the rat race.

I realized this the hard way after injuring my wrist while snow skiing. It was my “wake up” call in that if I couldn’t use my hands as a dentist, I wouldn’t be able to provide for my family.

| Strategy | Description | Key Points |

|---|---|---|

| Exploring Side Hustles | Generate additional income through skills or hobbies. |

|

| Starting Your Own Business | Launch an online business or store. |

|

| Investing Wisely | Generate passive income through investments. |

|

Building Wealth

To move beyond the rat race and achieve financial freedom, focus on understanding and increasing your cash flow while leveraging passive income streams to build lasting wealth.

Leveraging Passive Income

Passive Income involves earnings derived from ventures in which you are not actively involved daily. This could include:

- Rental income from real estate investments (my favorite).

- Earnings from stock dividends.

- Revenue from a business that does not require direct involvement.

- Interest from savings accounts or bonds.

To effectively leverage passive income, consider the following steps:

- Identify various passive income sources: Find opportunities aligned with your interests and financial goals.

- Calculate initial investment and potential returns: Assess how much you need to invest and the realistic monthly income you can expect.

- Diversify: Spread your investments across different assets to mitigate risks.

Bottom Line

You’ve made it to the end, which tells me that you are SERIOUS about getting out of the race that nobody can win.

More than likely, you NOW understand the solution.

It’s reaching financial independence as quickly as possible.

That’s it.

That’s the first thing to do, yet so few will ever achieve it.

The first step to becoming financially independent is to manage your spending. Remember that budget we talked about earlier?

This is an important thing to do, as your goal is to replace monthly expenses with passive income.

After that happens, congratulations…you’ve reached FI and can now EXIT the race.

Related article: How To Calculate Your FI Number

Here’s Robert Kiyosaki’s 3-step formula to achieve FI:

- Buy assets that generate cash flow (i.e., rental properties)

- Use the passive income from the assets to pay for living expenses

- Once monthly cash flow from assets equals or exceeds monthly living expenses, you’re financially independent.

FAQs

What are effective strategies for leaving a conventional career path for a simpler life?

To transition to a simpler life, start by reducing expenses, increasing your savings rate, and developing income streams independent of your primary employment. It’s also beneficial to cultivate skills that align with your passions and could lead to income opportunities.

Which locations are considered optimal for those looking to escape a high-pressure lifestyle?

Ideal locations for escaping a high-pressure lifestyle are those with a lower cost of living, a supportive community, and employment opportunities in line with your chosen simpler life. These might include small towns or rural areas where the pace of life tends to be slower.

What financial steps should one take to prepare for a significant lifestyle change to avoid the ‘rat race’?

Begin with a comprehensive assessment of your finances. Then, create a budget, eliminate debts, and build an emergency fund. Consider consulting a financial advisor to help with investment strategies that can provide passive income, easing your transition out of the traditional workforce.

Are there online resources or communities that provide support for individuals seeking to leave their high-stress jobs behind?

Yes, there are numerous online platforms. Look for forums, social media groups, and websites dedicated to minimalism, financial independence, remote work, or entrepreneurial ventures. These resources can offer advice, networking opportunities, and moral support.

What literature or books offer insights into breaking free from an endless cycle of work and consumption?

Several books provide insights on this topic. For example, “The 4-Hour Workweek” by Timothy Ferriss offers strategies for automation and remote work. Meanwhile, “Your Money or Your Life” by Vicki Robin and Joe Dominguez focuses on transforming your relationship with money and achieving financial independence.

How quickly can a person realistically transition from a traditional 9-to-5 to a more relaxed and autonomous way of living?

The timeline varies widely depending on individual circumstances. Some may require a few months to plan and execute, while others may take several years to achieve the necessary financial stability and personal readiness.

Is starting a side hustle a realistic way to eventually leave my corporate job?

Yes, starting a side hustle is a realistic and often effective strategy for those looking to leave their corporate job for something more fulfilling or lucrative. Side hustles offer a great opportunity to earn extra money, gain new life experience, and test out a business idea without the immediate need to give up your day job. For many, a side hustle in areas like graphic design, running an online store, or creating a YouTube channel can turn into a full-time career. This transition allows for a better work-life balance and the chance to pursue personal passions. The key to success lies in dedicating enough time and hard work to grow your side hustle while maintaining financial stability through your main income source. This dual focus can provide the financial runway needed for a smooth transition to becoming a full-time business owner, moving you closer to financial independence and the ability to retire early.