5 Steps: How To Become a Millionaire In Your 40’s

Want to be a millionaire?

Most doctors and other high-income earners should have an easier time to obtain millionaire status versus the average person.

But they face two major hurdles:

- #1 Late start

- #2 High debt

Depending on your profession, you may not start earning a steady paycheck until well into your 30’s.

Combine this with the typical amount of student loan debt that goes along with professional training and you’ve set yourself up way behind the pack.

Unfortunately, many docs stay in this poor financial position much longer than they should even with a six-figure income.

Good news…help is on the way!

One of the reasons that I started this site was to take doctors down a path from high debt to financial freedom.

And setting your sites on millionaire status is a great place to start.

How Do You Calculate If You Are a Millionaire?

In Chris Hogan’s book, Everyday Millionaires, he states that there’s two components to the word “millionaire”:

- emotional component

- mathematical component

At the emotional level, people want to eventually experience financial independence (FI).

They want to live life the way they choose to, not chained to a JOB (just over broke).

But the mathematical component is where confusion comes into play as many aren’t sure what the definition of a millionaire actually is.

Hogan defines a millionaire as someone with a net worth at or above $1 million dollars.

This is the same definition the authors of the classic book, The Millionaire Next Door, used as well.

Their formula states:

Net worth = Assets – Liabilities

So if Dr. NW owns a $400,000 condo yet owes, $200,000, his equity in the home would be $200,000.

If he also had:

- $50,000 in a 401k

- $8,000 in a savings account

- $2,000 in a checking account

- $10,000 value in his paid-for-car

Total Net Worth = $370,000

Got it?

Join the Passive Investors CircleWhat Percentage of 40 Year Olds Are Millionaires?

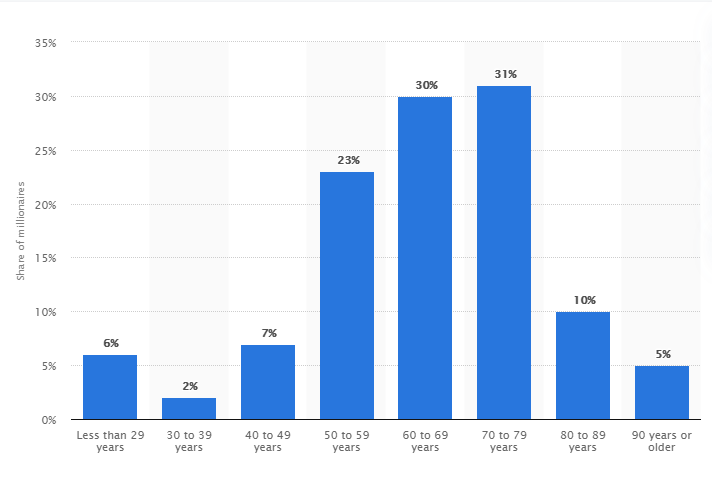

According to Statista, here are the distribution of U.S. millionaires in 2019 by age:

According to the above diagram, only 15% of the U.S. millionaire population is younger than 50 (6% + 2% + 7% = 15%).

If you’re a sub-50 year old millionaire then congratulations, you rock!

If You Can’t Beat Em… Join Em

We’ve discussed what it takes to become a millionaire time and time again. There are many different ways to achieve this so I won’t waste your precious time going over each and every one.

What I am going to do for you is take the BEST investing tactics I feel that doctors can use to become a millionaire within the shortest time period.

I’m going to mainly focus on habits of millionaires and how we can use them to better our finances.

Let’s dig in….

5 Best Investing Tactics of Millionaires

#1 Start Early

I can’t stress this enough. The longer you wait, the harder it’s going to be.

This is especially true for doctors due to the late start making real money. But that’s OK as their above average income can help make up for lost times.

Starting early allows you to take advantage of compound interest which is how you earn interest on your interest.

Interested? 🙂

Check out this example from Bankrate.com’s Save a Million Dollars Calculator.

I plugged in some numbers for two different scenarios that I felt would be attainable by most doctors:

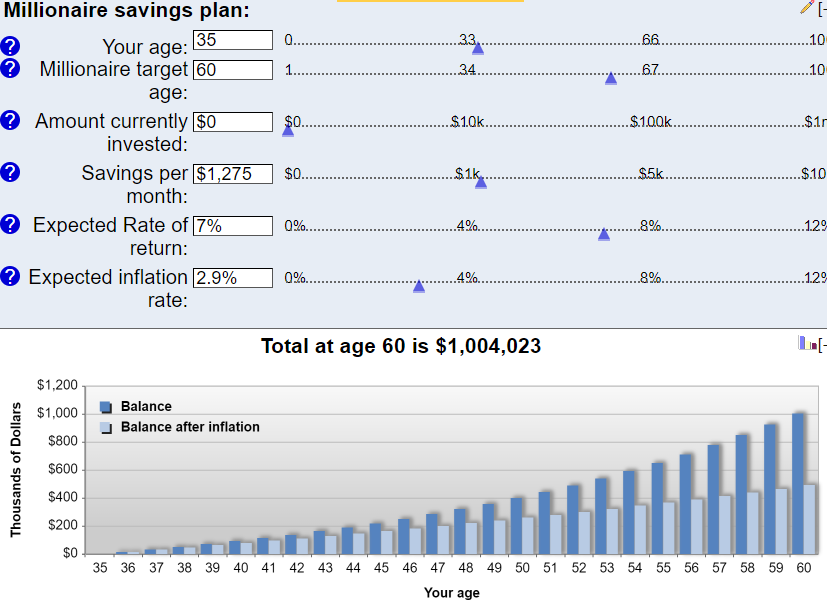

Example #1

For the 35 year old doctor starting with no savings and wanting to save a million dollars by age 60:

It would only take saving $1,275 a month with a 7% expected rate of return to bank a million bucks. Should be easy making six figures.

But the purpose of this article is how to do it much earlier in life.

Here’s a different scenario.

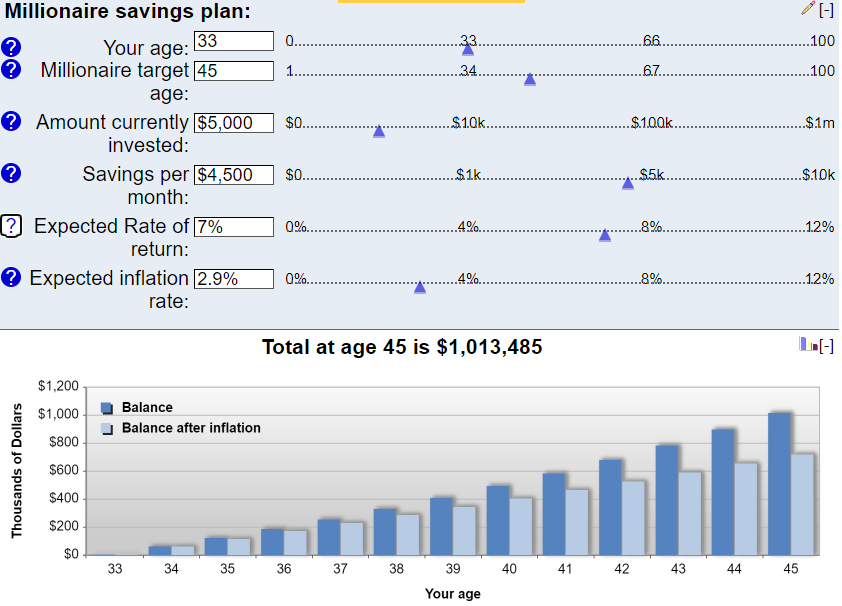

Example #2

33 year old doctor with $5,000 in savings wanting to reach millionaire status in his 40’s:

With only saving $4,500 a month, this doc can reach millionaire status by the young age of 45!

#2 Live Within Your Means

If you’ve read the classic financial book, The Richest Man In Babylon, then this advice should sound familiar.

Yes, even though this idea seems simple enough, it’s very hard for high income earners to do.

Why do you think so many pro athletes are broke?

You got it. They NEVER learned this step.

I get that we’re constantly bombarded with marketing that tempts us to BUY NOW!

Why do you think I want to buy the new Tesla truck! 🙂

We work hard, sacrifice, and delay gratification so we DESERVE to have stuff, right?

It seems that everywhere we look, our friends are showing off their recent purchases or exotic trips on social media. We want that too!!

Unfortunately, too many of us give into this temptation from others to buy whatever they want leveraging credit.

You can now see how easy it is to get sucked into the vortex of living beyond your means.

If you want to know how to become a millionaire by 40, then start living within your means.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter#3 Reduce Taxes

Income taxes on your active income (not passive) will be one of if not your largest expense during your career.

If you plan on hitting the million dollar mark early on then minimizing your tax burden is key.

One of the ways you can achieve this is by investing in tax deferred accounts such as IRA’s and 401k’s.

The thought behind this is that you’re lowering your taxes now (which is probably close to 50%) in hopes of using this money in the future when your taxes are lower.

#4 Invest in Real Estate

One of the wealthiest people to ever live, Andrew Carnegie, said this about real estate:

“90% of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate.”

One of the major ways that you can use real estate to get to a million is by using the power of leverage.

Millionaires understand that leverage allows them to buy a much larger asset and increase the potential return on their investment than they could if they had to pay 100% of the purchase price upfront.

A perfect example is something that I’ve invested in for several years, real estate syndications.

This is nothing more than pooling your money in with others to buy an asset (i.e. apartment complex) that you’d not been able to afford by yourself.

Leverage is one of the ways that this is accomplished.

Three other reasons that real estate will help you get to a million dollars faster:

- Cash flow

- Appreciation

- Tax benefits

#5 Take Calculated Risks

Sometimes the word “risk” brings up thoughts of fear and negative connotations. We must remember that all risks aren’t the same.

On one hand there’s calculated risks which involves putting in a fair amount of research. And because of this, the chances of success are higher than failing.

On the the other hand we have the foolish risk. This is just as it sounds, foolish! These risks are undertaken without any type of due diligence being performed.

What happens is that you go into the situation blindly not knowing what’s on the other end.

The majority of millionaires take, you guessed it, calculated risks. They typically don’t go into anything unless they know beforehand that the odds are in their favor.

The more wealth you create, the more risks you’ll be able to handle. Make sure that you do your research and the math. Basically you should weigh risk vs reward.

Not every decision will be right. I’ve had my share of failures.

The key is to be able to make course corrections to get back on track.

Are you ready to become a millionaire?

Join the Passive Investors Circle to start down the path today.