What’s the Difference Between Earned vs Unearned Income?

It wasn’t until about seven years ago that I started searching for income sources outside of my dental practice. It took a minor wrist injury while skiing to make me realize I was depending 100% on the practice’s income.

Not a good plan to have especially when we have two HUNGRY teenage boys to feed!

Unfortunately, most doctors and other high-income earners never think twice about how fragile their “earned” income can be. Nor do they realize that there’s a BIG difference in the way it’s taxed versus other income types.

Do I have your attention yet?

If they realized that earned (active) income is the most highly taxed income, then they might think twice of how they buy their toys (cars, boats, ATVs, etc.).

If you don’t remember anything else from this article, remember this:

Active income is the MOST heavily taxed income there is.

Related article: 5 Outstanding Tax Strategies For High Income Earners

Do you want to keep working harder, seeing more patients each year in order to make the same income (or less) due to decreased insurance reimbursements or work SMARTER?

The choice is yours and it all starts with what types of income you’re focused on growing: earned vs unearned income.

For today’s purposes, earned and active income will be used interchangeably along with unearned and passive income.

Also, investment income is another type that we’ll save for discussion another day.

In order to build wealth where you don’t have to actively put in the hours to do so, it’s important to learn the basics of the tax code starting with the different ways the Internal Revenue Service (IRS) makes a distinction between earned income vs. unearned income.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhat Is Earned (Active) Income?

Earned income is most familiar to us as it’s what we make while actively performing a task (work).

While earning this type of income, we’re exchanging physical work for money.

In other words, you’re trading time for money.

Earned income can be made as an employee of another business or as a self-employed business owner.

Examples of earned income include:

- wages

- salaries

- commission payments

- tips

- self-employment earnings

- long-term disability benefits

- union strike benefits

In comparison to unearned income, earned income is the highest taxed of the two.

Unfortunately for most people, the majority of the money made is earned income which causes them to pay the most in income taxes.

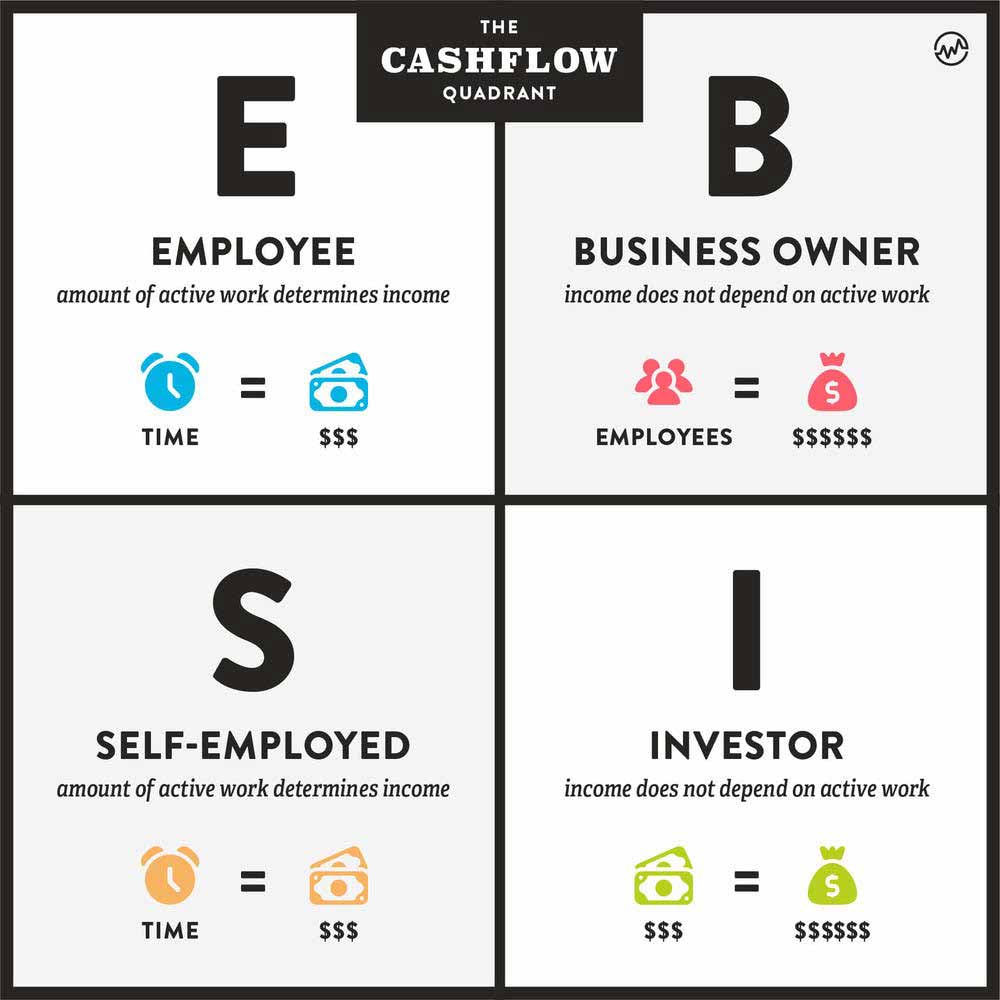

One of the most eye opening experiences I had regarding income and taxes happened after learning about Robert Kiyosaki’s Cashflow Quadrant.

Cashflow Quadrant

After reading Robert Kiyosaki’s book, Cashflow Quadrant, I suddenly realized that even as a self-employed periodontist, I was still trading time for money.

If I’m out of the office and not treating patients then no income is coming in. This situation is NO different than being an employee.

No work = No income

Kiyosaki claims that most people are on the left side of the quadrant which he calls the “poor side”.

I admit that I took a bit of offense to this when first reading it being self-employed but again, I swallowed my pride and realized that I was working hard and paying the most in taxes vs the right side of the quadrant which pays little to no tax.

Which side of the quadrant do you want to be on?

Taxes on Earned Income

I recommend new Passive Investors Circle members to begin educating themselves on how their income is taxed.

Taxes on earned income is broken into:

- federal income tax and state income tax

- payroll tax

Payroll tax include Social Security and Medicare tax and are withheld from employee’s paychecks.

Social security tax

The IRS deducts 12.4% to fund the Social Security Administration. Employers typically cover half (6.2%) and employees the remaining 6.2%.

For those of us that are self-employed (myself included), we pay the entire 12.4%. Remember about that left side of the quadrant?

Tax laws are constantly changing. Social Security tax is payable on earned or ordinary income received up to a specific limit called the contribution and benefit base.

For 2021, this limit is $142,800 .

If you make over this amount, no additional Social Security tax is owed.

Medicare tax

Next up is the Medicare payroll tax. It’s works similar to the Social Security tax as half is covered by the employee (1.45%) and the other half the employer (1.45%) for a total of 2.9%.

Unlike the Social Security tax, there’s not an earnings cap on the Medicare tax.

What Is Unearned (Passive) Income?

Unearned income or passive income is what I’m both passionate about pursuing and also teaching on this blog.

This income is made while you sleep (aka “mailbox money“).

In other words, you don’t actively have to perform a service in order to obtain it.

Now let me make something clear that others try to gloss over, you must FIRST make earned/active income in order to receive unearned revenue.

The more you make treating patients (earned income); the more you can invest in assets (i.e. real estate) that will provide unearned income.

According to the IRS, common types of unearned income includes investment-type income such as taxable interest, ordinary dividends, and capital gain distributions.

Other examples of unearned income:

- unemployment benefits/compensation

- taxable social security benefits

- real estate / rental income

- pensions

- annuities

- cancellation of debt

- interest income

- distributions of unearned income from a trust

Taxes on Unearned Income

One of the main differences between earned income vs unearned income is how they’re taxed. Unearned income is not subject to payroll taxes (Medicare and Social Security).

But unearned income will count toward your adjusted gross income (AGI) on your state and federal tax returns.

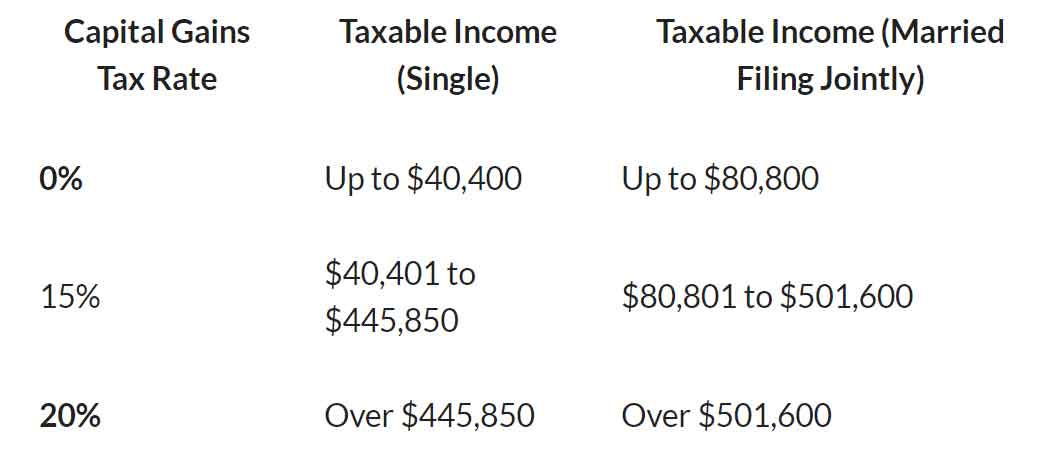

Certain types of unearned income, such as capital gains and qualified dividends, are taxed at a lower rate.

For example, tax on long-term capital gains is zero if you earn less than $40,400 and only 15% if you earn between $40,400 and $445,850 (see chart below).

This is why the wealthy focus on making money off their assets rather than their labor.

Would you rather actively work making $450,000 a year and see 35% on your federal income tax return or have $450,000 in passive income coming in and paying on 15%?

$157,500 in taxes (35%) vs $67,500 (15%) = $90,000 difference

Work smarter, NOT harder!

2021 Capital Gains Tax Rate Income Thresholds

Earned vs Unearned Income

If you’re in a situation where your income is directly proportional to you performing active work then hopefully the information shared today was a wake up call.

We now know that all income is NOT the same.

Yes, both earned vs unearned income is good (better than nothing) but being strategic about which you focus on during the different stages of your life will be the key to financial independence.

Early on in your career, focus on getting as good as you can at what you do to continue to grow earned income.

Yes, you’ll pay higher taxes but you’ll need that income boost to keep funding assets (i.e. real estate syndications) that will produce unearned income.

Join the Passive Investors Circle