I recently read the hard to find book, Simple Wealth, Inevitable Wealth by Nick Murray. In it, he discussed four behavioral tactics to be practiced during different “seasons” of one’s investing lifetime.

One of the behaviors was: “Invest the same amounts monthly, in the same funds, so as to harness the power of dollar cost averaging.”

He gave a great example and definition of dollar cost averaging (DCA) which reminded me of other books I’ve read about trying to time the market.

So what is the best way to invest? Dollar cost averaging vs market timing?

Let’s dig in and found out…

What Is Dollar Cost Averaging?

One of my goals this year was to begin listening to more podcasts while working out. I mentioned in a previous post that one of my favorite podcasts on real estate actually interviewed yours truly twice.

Listen Money Matters is another of my favorites that piqued my interest on finding out more on dollar cost averaging vs market timing.

Here’s the link to listen to them discussing DCA:

DCA Definition

The principle of DCA is quite simple. Actually, I’ve been doing it for years and didn’t know the technical term for it. By investing the same dollar amount each month (or each week in my case), you buy a larger number of fund shares when the market is down. Makes senses, right? In other words, you buy more and more aggressively as share prices drop.

On the flip side, when the markets start to go back up, your same dollar investment buys fewer shares as they become progressively higher priced.

After it’s all said and done, you end up with a below-average cost, because so many of your fund shares were purchased at relatively low prices and so few were bought at high prices.

And below-average costs leads to above-average returns.

This is the same advice that Warren Buffett has given out multiple times.

Warren says, “You should be fearful when others are greedy and be greedy when others are fearful.”

What Is Market Timing?

Investopedia defines market timing as:

Market timing is the act of moving in and out of a financial market or switching between asset classes based on predictive methods. These predictive tools include following technical indicators or economic data, to gauge how the market is going to move.

Do you remember 2008? Most investors do. An example of marketing timing are those investors who sold just before the bottom dropped and turned around and bought at the market lows in early 2009.

As you can imagine, these investors would have generated substantial returns.

However, the disadvantage of this strategy is that ultimate success depends on accurately predicting market peaks and troughs, which is impossible to consistently achieve.

Dollar Cost Averaging vs Market Timing

DCA Example

Here’s a great example of dollar cost averaging from Nick Murray’s book, Simple Wealth, Inevitable Wealth.

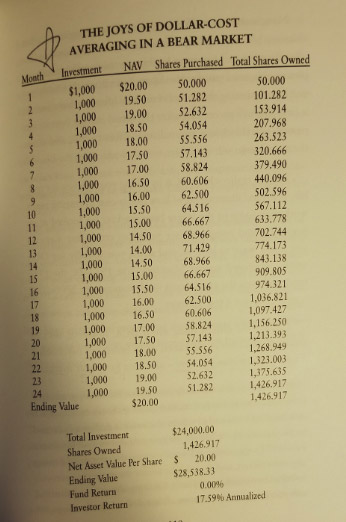

He highlights an investor that most would regard as having the worst possible “timing.” In the figure below, he starts investing $1,000 a month in a fund at its peak price of $20 a share in Month 1. The fund then declines 30% over the first year. ($20 in Month 1 down to $14.00 in Month 13)

In the second year, the fund begins its slow creep back up to its original value, $20 a share in Month 24.

DCA Result

At first glance of this example, you’ll notice that after two years, this fund has literally done nothing, right? Its’ price ended where it started, at $20.

Now, because this person utilized dollar cost averaging, he bought progressively more shares as the price started to drop and then fewer as it begin to go back up.

Net Result:

- Total Investment: $24,000

- Ending Value: $28,500

- Investor Return: 17.59%

Wait a minute! How did he earn over 17% when the share price NEVER went higher than what he originally purchased at $20/share? That doesn’t make sense.

Well, actually it does because of utilizing DCA.

He enjoyed a 17.59% annualized return because on average, ONLY half his capital was invested at any given time.

Bottom line: He obtained this great return in a market that basically was stagnant.

I loved Murray’s quote in the book after this example. He said, “DCA makes you love – and long for – bear markets.”

Marketing Timing Downfall

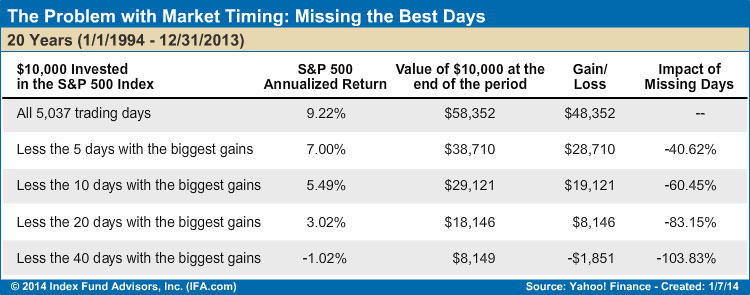

In an article from Index Fund Advisors IFA.com, they claim that almost all big stock market gains and drops are concentrated in just a few trading days each year. With that being said, potentially missing the biggest gaining days of the year/decade drastically brings down your investment returns.

In the figure below, they analyzed the S&P 500 during a 20-year period (1994 – 2013). During that period, it averaged 9.22% and an investment of $10,000 grew to $58,362.

Take a look at what impact NOT being the market on those big days had on overall returns. For example, if that investor missed the five best-performing days in that time period, the annualized return dropped to 7.00% with $10,000 growing only to $38,710.

A $20,000 difference!

You’ve probably heard it said before that personal finance comes down to behavioral finance. If you try to time the market by attempting to miss the bad days, there’s a chance you could miss out on the best ones too.

Comparing Dollar Cost Averaging vs Market Timing

Here’s a few more scenarios for you that compares Dollar Cost Averaging vs Market Timing:

A report from Dalbar’s Quantitative Analysis of Investor Behavior found that 75% of the time, investors who bought and sold mutual funds did it at the right time (i.e., when the market went up or down). Now before you get too excited, they also concluded that these same people still under-performed those that held the mutual fund for a longer period of time!

In the same report, they showed that investors that regularly move in and out of mutual funds instead of using a buy and hold approach underperform the S&P 500 by 3.52% over 20 years and by 6.3% over a shorter 3-year period.

In a Charles Schwab article titled, “Does Market Timing Work?” they compared “personal timing” to lump sum investing and Dollar Cost Averaging. They found that timing the market leads to significantly lower returns than Dollar Cost Averaging, but still better returns than not investing at all.

They also claimed that DCA helped to:

- prevent procrastination (forces to consistently invest)

- minimize regret when an investment proves to be poorly timed

Conclusion

The great thing with dollar cost averaging is that it forces you to get into the habit of investing money on a regular basis.

Now, some folks may still think that they can time the market, but I’m going to stick to investing a set amount automatically.