The great Albert Einstein said, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” I couldn’t have said it any better myself.

For anyone who wants to build lasting wealth and accomplish financial freedom, understanding and harnessing the power of compound interest is essential.

It’s also the reason the average millionaire in the U.S. makes less than $100,000 a year. They use compounding to their advantage.

On the flip side, it can also make things worse when you have interest compounding on debt.

In other words, it can work for you or against you, and we want it working for you.

What Is Compound Interest?

The simplest way to explain compound interest is…. that it’s interest on interest.

In other words, it works by calculating the interest on your entire account balance which also includes the interest that’s been accrued.

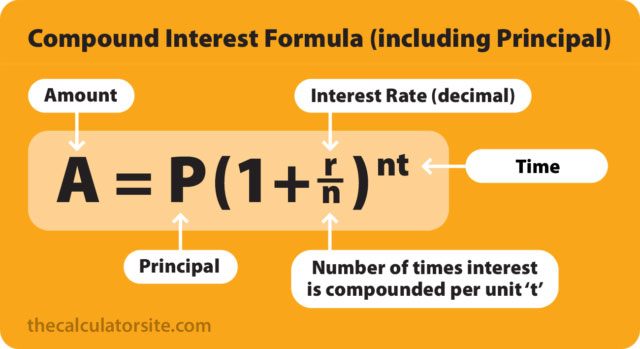

Here’s a compound interest formula for all you math scholars:

How Does Compound Interest Work?

Here’s a simple example:

Dr S invests $1,000 in a Vanguard index fund earning 10% a year

End of year 1 = $1,100 (10% of $1,000 = $100 in interest earned)

Now, at the beginning of year 2, there is $1,100 in the account.

If you earned 10% on $1,100 for year 2, the interest would be $110 instead of $100. See how that works?

10% x $1,100 = $110

Now Dr. S has $1,210 in the account.

$1,100 + $110 = $1,210

Let’s go out one more year.

Dr. S starts year 3 with $1,210 x 10% = $121

End of year = $1,331

As you can see, each year his interest is earning interest not only on the original $1,000 he invested, but on the interest that has grown since then.

In other words, it’s interest on the interest on the interest on the interest.

It compounds on itself, hence the name…compound interest.

An Example To Inspire Kids

If you have kids that like to play video games instead of working, look no further for inspiration from Dave Ramsey explaining how compound interest works.

You never know, it may excite them enough to put down the controllers and pick up a rake!

https://youtu.be/8eHDZSgNFbs

Ben and Arthur

Dave calls compound interest, “A millionaire’s best friend. It’s really free money.“

In the video above, he tells a story about Ben and Arthur that helps to dumb down the explanation of compound interest that makes it easy for kids to comprehend.

Heck, even I understood it!

Here’s the story (with my spin on it):

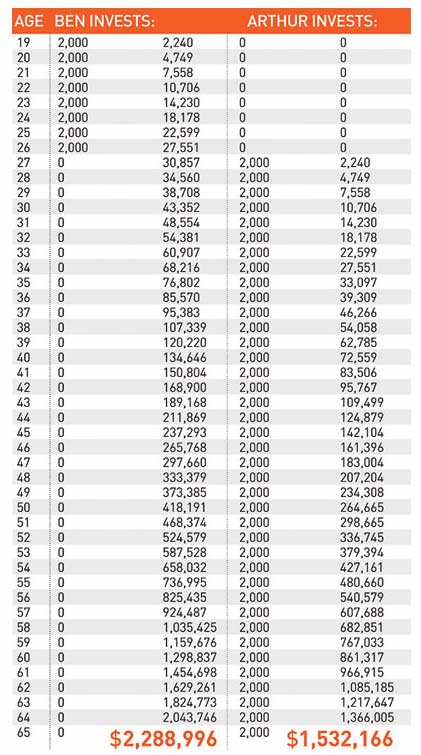

Ben starts reading this blog at an early age 🙂 and gets excited about investing money. So at 19, he opens an account starting with $2,000. Over the next 8 years, he annually saves this $2,000 in an index fund that earns him 12% in compound interest each year.

At the age of 26, Ben decides he wants a career change from mowing yards and decides to go to dental school after watching a rerun of Rudolph the Rednosed Reindeer.

He stops investing once he’s accepted to school and realizes that he’s only put a total of $16,000 of his money to work for him.

He thinks to himself that he’ll start back later in life after graduation and moves on.

Ben meets Arthur in dental school. Arthur is one of the school’s janitors that likes to shoot hoops with Ben on the weekends.

One day at lunch, the conversation turns towards investing and Ben informs Arthur about his investments before dental school.

It’s at this point that Arthur realizes that he’s behind the “investing” game. He opens an account and proceeds to start investing the same $2,000 into funds that also earn him 12% interest as Ben. Arthur starts this at the age of 27 and continues until the age of 65.

The Results

- Ben invests a total of $16,000 for 8 years from age 19 – 26.

- Arthur invests a total of $78,000 for 39 years from age 27 – 65.

Without looking at the end of the chart below, who do you think ended up with a larger portfolio by the time they were each 65?

If you guessed Arthur because he invested $78,000 you’d be…..wrong!

- Ben accumulated $2,288,996

- Arthur accumulated $1,532,166 (not bad for a janitor)

- Ben came out $756,830 ahead!

This is a perfect example to show why compound interest is the eighth wonder of the world and the importance of investing early in life versus waiting.

What Makes Compound Interest So Powerful?

Compound interest is the eighth wonder of the world because of the power it creates by using two things: Momentum and Time

1) It uses momentum which you can benefit from

Have you ever thought about how an avalanche starts? It begins with a single snowflake. That’s right, it starts small like many other great forces in our world. That snowflake combines with others to form a snowball.

Snowballs grow by snow being continually added to it until it gets so large that it then starts to roll downhill. It’s at this point that nature takes over and it becomes an unstoppable force.

Guess what? Building great wealth works the same way. A small amount of work must be done in the beginning to get things moving in the right direction. Compound interest starts to work in your favor once your wealth snowball is built.

Just as a snowball compounds and grows, so can your wealth.

2) Time is the BIGGEST factor

The biggest factor to growing your money with compound interest is time. The longer you leave your money to grow, the larger your account balance becomes.

A simple calculation to show the effects of time on your money is the “Rule of 72.”

This calculation shows the amount of time it takes for your investment to double with the impact of compounding.

Here’s how it works:

Divide the number 72 by the annual return percent.

The result is the number of years it will take for your investment to double.

For example, an index fund that averages 8% annually will double in 9 years.

72/8% = 9 years

No Patience, Know Patience

Unfortunately these days, technology has encouraged us to expect immediate rewards.

So when most people are told that it’s going to take a longer period of time to see significant returns on their investments, it can be demotivating.

Lack of patience is one of the reasons many people don’t invest. They don’t want to wait!

In the book, “Everyday Millionaires,” author Chris Hogan’s research stated that millionaire status was first reached at the age of 49.

Too many people want to reach it much earlier in life, but will be much more likely to do so if they invest automatically each month, enjoy the ride, and know that they’ll reach their goals if they have a plan.

How long do you have to wait?

Remember, the longer you wait to start investing, the longer it’s going to take to become wealthy.

Most docs don’t complete training until after age 30. If the average physician earns over $200,000 a year, then saving $1,000 or more each month shouldn’t be hard to do.

Even if they don’t start until age 40, saving $1679.23 a month shouldn’t be too difficult either.

But the pressure is on to save more the longer you wait to get started.

Bottom line: Start investing early and leave your investment alone to give it time to grow.

See How Fast Your Money Can Grow

As long as your investment is paying interest, nothing can stop it from growing. The longer it has time to grow, the richer you get!

If you want to see just how fast your money can grow, try using a compound interest calculator such as Financial Mentor’s compound interest calculator.

Here’s what Warren Buffet had to say about giving his money time to grow and utilizing compound interest:

“I always knew I was going to be rich, so I was never in a hurry to”. – Warren Buffett

Use the Power of Compound Interest to Your Advantage

Now that you understand how compound interest can help you move ahead with your finances, it can also be harmful when it comes to debt.

Harmful

Credit card companies compound the interest on any unpaid balances on a monthly basis. By knowing how powerful compounding can be, it can also compound in the other direction which should be an incentive to pay off debt as quickly as possible.

Helpful

Knowing that compounding allows you to make money from your money should also act as an incentive to squirrel away as much as you can and not touch it for a long, long time.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter