Cash On Cash Return

Recently I wrote about how I lost quite a bit of money investing in a crowdfunding deal that promised a high cash yield with RealtyShares a few years ago. This mistake was totally on me as I didn’t do my part to know what I was really investing in.

I put my trust in what their website was promoting regarding this potential investment instead of doing my own due diligence.

If you haven’t read the story, you can so so HERE.

I’ve come to believe that things don’t happen to you, they happen FOR you. In my case, this financial mishap sparked me to not only learn more about real estate deals and real estate investing, but also to seek out and form relationships with full time real estate investors and developers.

It’s much different knowing that you’re dealing one-on-one with another human versus a generic website posting deals that are supposedly “good” with high returns on investment (ROI) because they said so.

One of the questions I sought out to answer was regarding how to best evaluate an investment that we’re considering investing in.

If you talk to twenty different people, you’re likely to get twenty different answers.

It doesn’t matter if you’re investing in syndications, crowdfunding, REITs, self-storage, commercial property, or rental real estate, being able to evaluate investment opportunities correctly is a top priority.

As someone that focuses on passive investing and teaching others about apartment syndications, two of the return factors that must be evaluated are the cash on cash return (CoC) and the internal rate of return (IRR).

Let’s get into why these are so important, how they’re calculated and why they’re relevant in apartment syndications.

What is Cash-on-Cash Return?

Real estate mogul Kris Krohn says that the cash on cash return (CoC) is one of the MOST important figures he looks at when evaluating deals before pulling the trigger. The higher the cash on cash return the better.

He thinks about it like this:

Cash In vs Cash Out

We want to know for every dollar we put into an investment, what do we get out in return?

The CoC is a factor that refers to the return on the capital that you’ve invested into the property.

It’s the relationship between a property’s cash flow and the initial equity investment.

Here’s how to calculate the cash on cash return:

Cash on cash return = net operating income (NOI)/total cash investment

NOI = annual rental income – the operating expenses

The net operating income is also known as the “cash flow.”

Whenever someone is wanting to invest in apartment syndications, usually the cash flow is referred to the profits remaining after paying the operating expenses and debt service.

In other words, it’s what you’re going to have left in your pocket after all expenses and debt is paid each month.

Here’s a brief video of Eric Bowlin from Ideal REI explaining Coc:

2 Different Cash On Cash Return Versions

With regards to apartment syndication investing, you’ll occasionally see that there are actually two different versions of the CoC:

1) Includes the profits from the sale of the complex – will show passive investors how much money they should expect to make long term from the project as a whole.

2) Excludes the profits from the sale of the complex – will show passive investors how much money they should to expect to receive for each distribution during the hold period, as well as an average annual return on their investment.

In order to calculate both CoC factors, you need:

- initial amount of equity investment

- projected annual cash flow

- projected profit from sale for both the overall project and to the passive investors

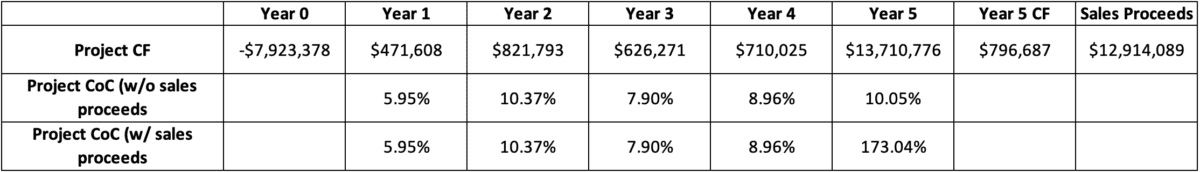

Here is an example from Joe Fairless of how to calculate CoC return for an apartment project (note: CF = cash flow)

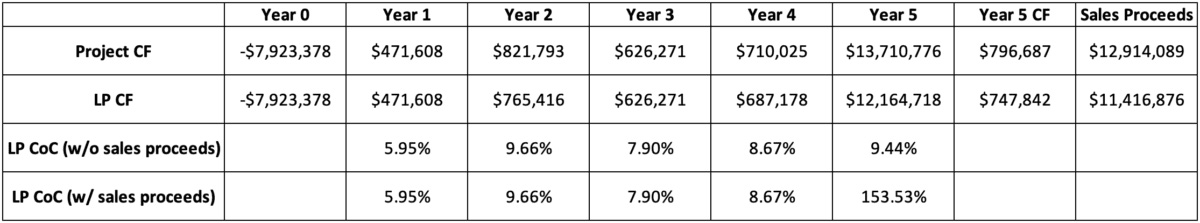

Here is an example of how to calculate the CoC returns to the limited partners (LP) (investors) based on an 8% preferred return and 70/30 profit split after the sale:

In this example, the average annual CoC to the Limited Partner (LP) is 8.33%.

Here’s the way it was calculated:

5.95% + 9.66% + 7.90% + 8.67% + 9.44%/5 = 8.33% annual return

This actually turns out to very good as it’s above the 8% preferred return originally offered.

The overall CoC for the five years is 185.72%.

In this case, if you’d have invested $100,000, you would have made $85,720 in profit.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhy the CoC is a Good Metric

Straightforward

I don’t know about you, but as someone that continues to see patients on a daily basis, I need to be able to look for deals and evaluate them in a straightforward manner.

To me, simplicity is key and I want to keep it as simple as possible. The CoC allows us to do that (especially us passive investors) as it’s easy to gauge what your return on the capital invested would be using the property’s net cash flow.

It’s no different than playing a slot machine. You put in a certain amount and then you get a certain amount back (hopefully) that will allow you to calculate your percentage return.

“Back Of Napkin” Analysis

I’ve got a patient that I see a couple of times a year that owns over 100 units in my area. As an active investor, he is also focused on how he’s going to finance the purchases he makes, closing costs, cap rates, etc.

He loves to inform me about the latest “happenings” in our local market and frequently brings in a list of all of the recently sold property.

Most of the time he uses a CoC to quickly show me different investments that are for sale and what their average returns would be.

Occasionally he uses the “back of napkin” analysis because these types of calculations are quick to point out the properties with the highest returns possible.

Gauge Your Distance To FIRE

If one of your goals is to FIRE (Financial Independence Retire Early) or even better fat FIRE (retiring early while still living it up), consider reading how this guy did it at the early age of 38 HERE.

For those of you aspiring to do this as well, you’ll need to know what your annual expenses are in order to build enough passive income to cover them.

Using a cash on cash return evaluation is important to evaluate the different properties to invest in so you can meet these goals to become financially independent.

Join the Passive Investors CircleWhy the CoC is a Bad Metric

Taxes

Taxes is a dreaded word among the doctor community but it’s a fact of life. We all have to pay them. Some of us “evil people” have to pay more than others.

No matter what type of investment you’re in, taxes play a role. Even though your specific tax situation may not impact the performance of the asset you’ve invested in, its performance will impact your tax situation (either directly or indirectly).

This could greatly affect your actual returns either positively or negatively.

The downside of using the CoC is that it doesn’t take taxes into account when trying to calculate the actual return on an investment.

Biggerpockets example

Here’s an example from Biggerpockets:

For instance, let’s say your annual pre-tax cash flow is $10,000, resulting in a 10% cash-on-cash return (assuming you invested $100,000).

If you’re in the 25% tax bracket, your after-tax cash flow is $7,500 resulting in a 7.5% actual return.

Further, we have to take depreciation and amortization into account. In the example above, if your depreciation and amortization amounts to $8,000 annually, then only $2,000 of cash flow is remaining to be taxed.

At the same 25% rate, our tax liability is $500. Since depreciation and amortization are “phantom” expenses, our after-tax cash flow is $9,500 ($10,000-$500), resulting in a 9.5% actual return.

Profit Potential Varies

Another reason the Coc isn’t the best metric is because it doesn’t take into account the principal portion of your loan payment (mortgage paydown).

We know that some of the payment goes to paying down the mortgage and the other goes towards the interest portion.

Also, more than likely the property will appreciate in value the longer it’s held. The Coc doesn’t calculate for this but you’ll have more in your pocket when the property is sold.

What Is A Good Cash On Cash Return?

Unfortunately, there’s no specific rule of thumb regarding what constitutes a “good” Coc. It all comes down to the individual investing in the deal.

Some seasoned investors feel that a projected CoC of 8-12% is good while others think that 5-7% is acceptable depending on the market.

Some people are nearer retirement and want less risk while others want to take on more risk as they still have several years (or decades) of work ahead of them.

Again, it’s all about a person’s specific goals.

If you only want deals over 10% then go for it. If you want 6%, then only focus on those. You have do it what’s right for you because only YOU know what your risk tolerance and investing goals are important to you.

You want to be able to sleep better knowing that you’re doing what’s right for you and your family.

The Bottom Line

My entire goal for this site is to educate you about the in’s and out’s of real estate investing. My main focus in on passive investing as most of us don’t have time to manage tenants. (Have you joined the Passive Investors Circle?)

As I continue to learn myself, I plan on passing along my wins (and losses) to you so you can make an educated decision what’s best for your investment goals.

The first step in the vetting process starts with the numbers and the cash on cash return is an easy metric to start with.