Rich Dad’s Cashflow Quadrant: A Summary That’ll Transform Your Thinking

Have you ever wondered why some people seem to “never” work yet always are enjoying themselves?

These people golf or tennis during the week and travel the world, yet here we are, still grinding it out every day at work.

As a periodontist, I’ve thought about this too and until I figured out why it was happening, I have to admit, I was jealous.

Eventually, the jealousy turned to anger as I realized I’d been duped into believing I HAD to get a professional degree in order to make a good income. Wrong!

It wasn’t until I read Rich Dad’s Cashflow Quadrant that reality set into the fact that I’d been focused on making money the WRONG way.

The good news is that it’s NOT too late to change, no matter what career you’re in.

Kiyosaki’s first book, Rich Dad Poor Dad, taught me about:

- building passive income

- how wealthy people operate

- tax breaks I should be using

- obtaining true freedom

- making my money work for me (instead of the other way around)

If you’re ready to learn the best ways to exit the rat race, read on….

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhere Did You Learn About Money?

Did your parents ever teach you that “money doesn’t grow on trees“?

Did you ever hear “We can’t afford that” or “What do you think we’re made of…money“?

Yeah, me too.

It’s not that our parents didn’t love us, it’s probably the same thing their parents taught them. It’s a poverty/scarcity mindset that seems to be passed on from generation to generation.

Unfortunately, if you grow up hearing this your entire childhood, it’s hard to break out of that mindset unless you learn something that makes you question your belief system.

The worst part is that even though we’re taught to go to school, study hard, make good grades, and get a college degree for a high-paying job….our education system teaches us ZERO about money.

You’d think at some point during the 25 years I spent in the classroom that I’d at least heard something about money. But too bad I didn’t. Maybe that’s why our country has a student loan debt crisis.

My education about money began with reading Kiyosaki’s Rich Dad Poor Dad, only a year after I’d read The Millionaire Next Door. Both books are about finances yet are light years apart in what they teach.

If you want to learn about millionaires that work 40+ years, live frugally, and are set to rely on their 401k, then The Millionaire Next Door is for you.

Related video:

If you want to learn how to create great wealth with passive income that doesn’t involve much of your time, then Kiyosaki’s book would be a better fit.

Rich Dad Poor Dad

Rich Dad Poor Dad highlights how Kiyosaki learned financial advice (from his “two” dads). His “rich dad” was his best friend’s dad, and his “poor dad” who was his real father.

His “poor dad” was a college professor and, like many educated people working a 9-5, still struggled with money his entire career.

Kiyosaki’s “rich dad” was one of the wealthiest businessmen in Hawaii, with only an eighth-grade education.

During his early years, Kiyosaki noticed differences in both of his father figures.

He stated, “I noticed that my poor dad was poor, not because of the amount of money he earned, which was significant, but because of his thoughts and actions.“

Many of my physician and dentist friends are also poor (not because of their income) but due to their scarcity mindset.

The book highlights six important lessons that he learned about building wealth over a thirty-year period from his rich dad.

6 Rich Dad Poor Dad Lessons

Lesson #1: It’s not how much you make; it’s how much you keep.

This lesson reminded me of doctors and pro athletes. Both put in hard work for money, yet most never learn how to manage it.

Here’s the BIG lesson Kiyosaki teaches about this, “You must know the difference between an asset and a liability and buy assets. If you want to be rich, this is all you need to know. It is rule number one. It is the only rule.”

The rich buy assets vs the poor and middle class buy liabilities they THINK are assets. This is why the rich have financial security, and the poor continue to have money problems.

It doesn’t matter your income, if you continue to focus on growing your liabilities (cars, boats, houses, etc.) you’ll NEVER have much money.

Assets put money in our pockets, and liabilities take money out.

Lesson #2: The poor and the middle class work for money, whereas the rich have money work for them.

“If you don’t find a way to make money while you sleep, you will work until you die.” – Warren Buffett

We’re going to get into the Cashflow Quadrant shortly, in which the main goal is to get from the left or “poor” side to the right or “rich” side of the quadrant.

The poor side trades time for dollars vs the right side gets their money to work for them.

In school, we’re taught to work for money. If you want true time freedom, get out of this trap as fast as you can.

Lesson #3: It’s not the smart who get ahead, but the bold.

The book states we need to take risks while accumulating wealth, but just as important is managing that risk. This is where having some sort of financial literacy is key.

Kiyosaki teaches, “There’s always risk. It is financial intelligence that improves the odds.”

Becoming more financially intelligent starts with self-education with topics such as:

- accounting

- investing

- stock market

Before you invest money, make sure you completely understand both the risks and rewards.

Lack of financial education, teamed with the desire for quick riches, leads to disaster.

Lesson #4: Corporations are the biggest secret of the rich.

A rich person understands that to lower their tax rate, they must learn how to set up corporations.

One of the main differences between an employee vs a corporation is how corporations pay taxes.

Corporations

1. Earn

2. Spend

3. Pay Taxes (last)

Many of the corporation’s expenses can be written off, which in turn lowers taxes.

Employees who work for Corporations

1. Earn

2. Pay Taxes

3. Spend (what’s left over)

Employees typically pay more in taxes based on not being able to expense purchased items.

Lesson #5: The rich focus on their asset column while everyone else focuses on income statements.

The key quote in this lesson was: “Keep your daytime job but start buying real assets, not liabilities or personal effects that have no real value once you get them home. Keep expenses low, reduce liabilities, and diligently build a base of solid assets.”

The bottom line in this lesson is to use money from your career to invest in wealth-building assets and then let the passive income from the assets buy your liabilities.

Wow, that’s a different way of thinking, right?

Lesson #6: People who avoid failure also avoid success.

“Most people never win because they’re afraid of losing, or failing.” – Robert Kiyosaki

The majority of successful people get to where they are because of the mistakes and failures they’ve made.

When I first started investing in real estate syndications, I made the mistake of starting off crowdfunding.

Here’s my BIG mistake: What I Learned From Losing $50,000

The book states that if you look at the way the average person is designed to learn, we learn by making mistakes. For example, we learn to walk by falling down. The same is true for learning to ride a bike. The same is also true for getting rich … Failure is part of the process of success.

“The cost of failure is cheap compared to the cost of inaction. Failure at least means you learned something and are better prepared for next time. If you NEVER get started, there IS no next time. Everything worthwhile is HARD before it gets easy.” – Ron Caruthers

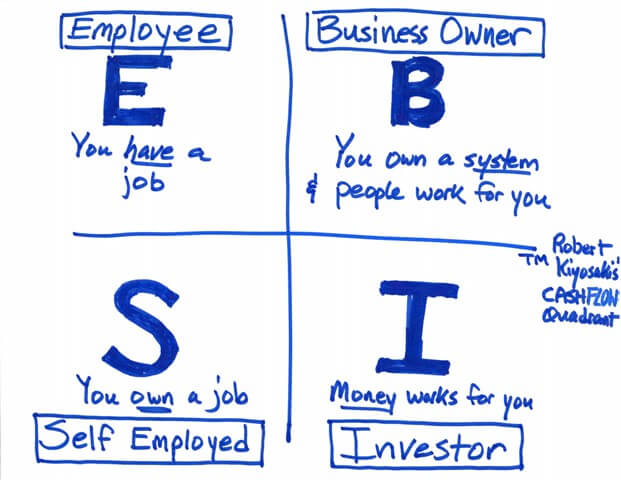

The Cashflow Quadrant

Kiyosaki learned about the Cashflow Quadrant from his “rich dad.”

Essentially, it’s a way to categorize people based on where their money comes from:

In the Cashflow Quadrant, Kiyosaki teaches the four ways people make money:

- Employee

- Self-employed person

- Business Owner

- Investor

E- Employee

Individuals who make their money as employees value having a secure job more than anything else. They despise economic uncertainty and fear this the most.

An employee can range from a janitor to a brain surgeon working for a hospital. It’s not WHAT they do for a living; it’s HOW they’re making money.

Employees mainly tend to focus on what they make for a living and not on assets.

Something else to consider, employees along with self-employed people, pay the MOST in taxes.

If people in this quadrant want more money and don’t want to move to the right side of the quadrant, they must work MORE hours. This causes them to continue to trade even more time for money.

As a side note, I’m starting to see more dentists and physicians practicing as an employee due to:

- high student loan debt

- starting a practice is cost-prohibitive

Pros and Cons of Being an Employee

The main pro of being an employee is the reduction in financial uncertainty. Other pros can include paid time off, 401k match, and health insurance.

On the flip side, even if your performance is great, it’s typically not reflected in your salary. If you were in the other quadrants, you’re generally paid according to your performance. And don’t forget, to make more, you must trade MORE time in the form of extended hours or shifts.

S- Self-employed or Small Business Owner

If I were to choose one word to describe the self-employed individual, that word would be “independence“.

The main reason I chose to exit the employee quadrant and enter the S quadrant was to be my own boss. I didn’t want to have to answer to anyone and liked the fact that I could hire whoever I felt was best for the practice.

The way these people respond to financial fear is NOT by seeking security, but by taking control and doing it themselves.

But shortly after opening my practice, it didn’t take long to realize that even though I owned the practice, the practice owned me.

I was still trading time for money and paying a boatload of taxes.

Pros and Cons of Being Self-Employed

As previously mentioned, the main pro is working for yourself and having control of the direction you want your business/practice to go.

The main con is lack of security, which involves a higher risk than the employee.

Research shows that 8 out of 10 small businesses don’t make it within the first five years.

B – Business Owner

After practicing for a decade, I started to take notice of some of my friends who could take a month or two off in the Summer. I realized that these individuals resided in the Business Owner category as they had systems in place with employees running the show.

My friend owns the local health club, which operates with or without him present. He understands how to outsource and delegate responsibilities to others. He doesn’t want to do it all himself and has chosen to surround himself with others to do the work.

Unlike those in the E and S categories, business owners don’t trade time for money. What a great feeling to have.

Like investors, they pay much less in taxes than the left side of the quadrant.

“Business owners can take vacations and still make money, and they don’t have to actively work to earn an income.” – Robert Kiyosaki

Pros and Cons of Being a Big Business Owner

The main pro of being a big business owner is having time and freedom. Also, more of the business profits can go into your pocket as you’re having to pay less in taxes.

But, as with any business, there is always the possibility of losing money. Also, these people must be good leaders as they’re relying on others to run the systems in place.

I – Investor

Investors don’t trade time for money. Instead, they invest in hard assets that make money for them. Many of them set up their life to have their assets pay for their liabilities.

According to Kiyosaki, the B and I quadrants (right side) pay the least amount in taxes and is where true financial freedom is found.

Typically, Investors start making money in one or more of the other quadrants and then put that money to work for them.

They often purchase assets like company shares and real estate that generate cash flow, which allows them to retire much earlier than what you’ve been led to believe.

Pros and Cons of Being an Investor

The main pro of being in the Investor category is achieving financial freedom rapidly via passive income streams.

The only limitation of being an investor is financial uncertainty.

Which Side Of The Cashflow Quadrant Are You On?

Active Income

Kiyosaki states the majority of people are on the left side or “poor side” of the quadrant. They tend to operate as either an employee or self-employed individual their entire career.

Most of the physicians and dentists are in these categories mainly trading their time for money.

No patients = No money

I realize that if I never exit the S category, I’ll always trade time for money.

Passive Income

The book’s main focus is to get you thinking how to acquire financial independence which involves moving to the right or “rich side” of the quadrant.

This is where we start generating passive income to replace active income. Unfortunately, most doctors and other high-income professionals NEVER shift to this side which can lead to burn out.

With passive income (aka mailbox money), you’re able to leverage people and money to increase your wealth, even while you’re busy doing other things.

You’re literally making money while you sleep.

If you’re ready to start down the path to financial freedom, join the Passive Investors Circle today.

Join the Passive Investors CircleFAQs

What are the different quadrants in the Cashflow Quadrant, and how do they relate to job security and financial goals?

The Cashflow Quadrant consists of four sections: the E (Employee) and S (Self-Employed) quadrants on the left side, and the B (Business Owner) and I (Investor) quadrants on the right side. The left side often focuses on job security and a steady income, typically through a high-paying job or self-employment. The right side, however, emphasizes creating passive income streams and achieving financial goals through owning businesses or making investments.

How does transitioning from the S quadrant to the B quadrant impact personal finance and free time?

Moving from the S (Self-Employed) quadrant to the B (Business Owner) quadrant can significantly affect personal finance and free time. While the S quadrant often requires long hours and direct involvement, the B quadrant focuses on owning a business that operates independently. This transition can lead to increased personal income, more free time, and greater financial success.

Why are true investors in the I quadrant considered to be in the best position for financial success?

True investors in the I (Investor) quadrant are often seen as in the best position for financial success because they earn income through investments like rental properties, stocks, or network marketing. This quadrant allows for leveraging money to create more wealth, often leading to financial independence and a solid retirement plan, without relying solely on a regular job or pension plans.

What are the risks and rewards of being in the riskiest quadrant, and how does it differ from the other quadrants?

The self-employed quadrant is often considered the riskiest because it depends heavily on the individual’s continuous effort and doesn’t provide the same job security as the employee quadrant. Unlike the B and I quadrants, which focus on creating systems for generating income, the self-employed need to manage their time and resources effectively. However, it offers the potential for higher personal income and the satisfaction of owning one’s own business, unlike the steady income and pension plans associated with the E quadrant.

Can someone achieve financial success by staying on the left side of the Cashflow Quadrant, or is the right side essential?

While it’s possible to achieve a certain level of financial success on the left side of the Cashflow Quadrant through a high-paying job and prudent personal finance management, the right side offers paths to greater financial freedom. The right side (B and I quadrants) allows for generating passive income, like rental income or earnings from investments, providing opportunities for wealth accumulation beyond regular employment. However, success on either side requires understanding personal finance and taking small steps toward your financial goals.