Blog

-

Rent Concession: What Is It and Should You Offer One?

Rent Concession: What Is It and Should You Offer One? Rent concessions can be crucial in the rental market, especially for landlords looking to fill vacancies. A rent concession is a temporary incentive landlords offer to attract and keep tenants. These incentives can take many forms, such as: reduced rent waived fees added amenities They…

-

The Four Agreements by Don Miguel Ruiz Book Summary

The Four Agreements by Don Miguel Ruiz Book Summary In “The Four Agreements,” Don Miguel Ruiz shares a guide to personal freedom based on ancient Toltec wisdom. The book highlights four key agreements that, when practiced regularly, can transform your life by helping you overcome self-limiting beliefs and achieve true happiness. Speak with Integrity: Be…

-

How To Buy a Campground With No Money Down

How To Buy a Campground With No Money Down Entering the campground business can be an exciting and profitable venture. With over 16,000 campgrounds across the U.S. and 40 million Americans regularly RVing, the demand for camping spots is high. Whether you’re planning to acquire an existing campground or start one from scratch, it’s essential…

-

Is Accumulated Depreciation An Asset In Real Estate?

Is Accumulated Depreciation An Asset In Real Estate? Accumulated depreciation is important in real estate accounting because it shows the true financial health of a company. It isn’t listed as an asset on the balance sheet; instead, it’s a contra-asset account that lowers the value of the related asset. This amount shows the total depreciation…

-

Rich vs Wealthy: Is There a Difference?

Rich vs Wealthy: Is There a Difference? Rich means having a high income and the ability to buy a lot of STUFF, but true WEALTH involves lasting financial stability and freedom. While being rich is often about current earnings (e.g., being a doctor or dentist), being wealthy means having assets that generate ongoing income, ensuring long-term security.…

-

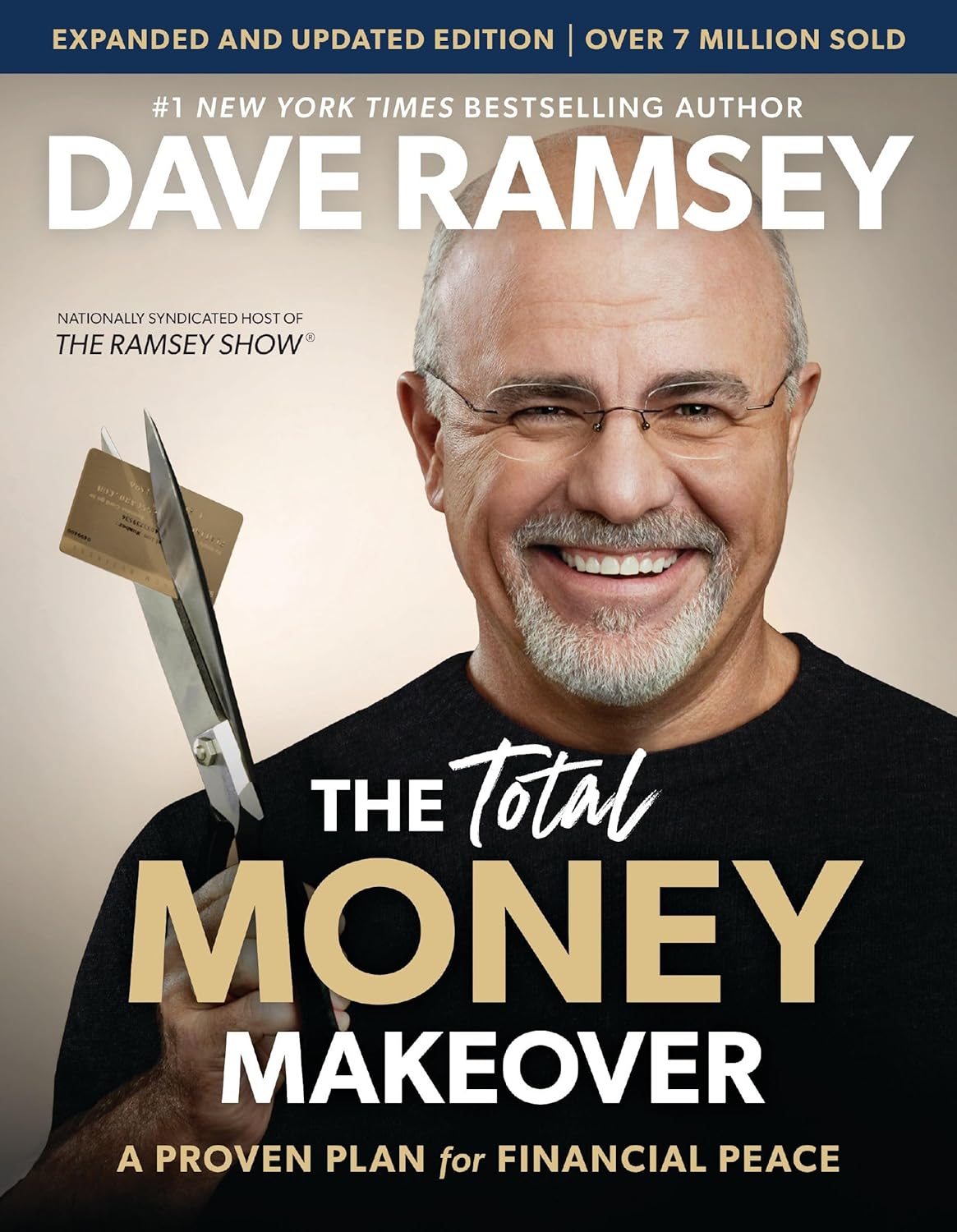

Total Money Makeover: The Plan I Followed for Financial Freedom

Total Money Makeover: The Plan I Followed for Financial Freedom Looking to transform your finances and achieve financial freedom? After dental school, I was $300k in student loan debt. The worst part was that my job offer fell through, forcing me to open a practice from scratch. Our finances were all over the place, but…

-

The $4.2 Million Gamble: Inside Our High-Stakes Mobile Home Park Transformation

In February 2023, my business partner and I purchased a mobile home park in South Louisiana for $4.2 million. Just one year later, it’s valued at $8.4 million, and it’s still climbing. Here’s a simplified version of our journey. From Purchase to Profit: The First Steps Finding the Opportunity The park is strategically located between…

-

Accredited vs Non-Accredited Investors: What’s the Difference?

Accredited vs Non-Accredited Investors: What’s the Difference? Accredited investors meet certain income or net worth criteria set by the SEC, allowing them to participate in a wider range of investment opportunities. Non-accredited investors, on the other hand, do not meet these financial criteria and are typically limited to more regulated and transparent investment options. Understanding…

-

How to Use a Self-Directed IRA for Real Estate Investing

How to Use a Self-Directed IRA for Real Estate Investing Investing in real estate through a self-directed IRA allows you to diversify your retirement portfolio beyond traditional stocks, mutual funds, and bonds. Unlike a traditional IRA, a self-directed IRA allows you to invest in alternative assets, including real estate. This means you can use your retirement savings…

-

$2M Debt: My Financial Planning Session with a Struggling Dentist

$2M Debt: My Financial Planning Session with a Struggling Dentist Dentists face unique financial challenges that make managing their personal finances and planning for the future complex. From balancing student loan repayments to investing in a practice, the financial decisions they make today can impact long-term financial health. Having a strategic plan in place allows…

-

Why I Invest in RV Parks: Unlocking High Returns & Income Streams

Why I Invest in RV Parks: Unlocking High Returns & Income Streams Have you ever wondered why some investments offer more security, higher returns, and greater flexibility than others? If you’re tired of the limited income potential from traditional real estate investments like apartments, you might be surprised to learn that RV parks could be…

-

What is Cost Segregation? A Real Estate Investor’s Guide

What is Cost Segregation? A Real Estate Investor’s Guide Cost segregation is a tax strategy that allows real estate investors to speed up the depreciation of various components of a property, thus resulting in significant tax savings. A cost segregation study is conducted by a specialist (engineering firm or CPA) who analyzes your property and breaks it…