5 Outstanding Tax Benefits Of Real Estate Investing

If you’re a high-income earner, it’s probably safe to say that you’d like to avoid taxes at all costs, right? We’ve looked at different tax advantages in the past with ideas how we can reduce out taxable income.

One of the main reasons that readers of this blog join the Passive Investors Circle is to find out ways to lower their large income tax bill. Specifically, they want to know all of the tax deductions and wonderful tax benefits of real estate investing that’s out there for the picking.

Regarding taxes, it’s one of the 4 MAIN ways to make money in real estate.

Before we take a deep dive into the tax benefits of real estate investing, let’s quickly review the three other ways first.

Disclaimer: I am not a tax professional only a periodontist! Make sure that you consult your CPA or tax professional before making any decisions.

How To Make Money In Real Estate

#1 Cash flow

“Buying or building assets that deliver cash flow is putting your money to work for you. High-paying jobs mean two things: you’re working for money and the taxes you pay will probably increase.” – Robert Kiyosaki

Cash flow is something that author Robert Kiyosaki talks about quite frequently in his books such as:

Cash flow is how we can self-medicate ourselves to relieve the symptom of the fear of running out of money during retirement.

What is cash flow?

Here’s a couple of basic formulas you should know regarding cash flow from rental property:

- Gross rents – expenses = Net Operating Income (NOI)

- NOI – debt – long-term repairs = Cash Flow

*My goal for you is to get you motivated to create multiple streams of income through passive investments.

When you invest properly in a correctly managed apartment complex, it produces a positive cash flow in excess of expenses.

- Positive cash flow = a surplus

- Negative cash flow = a deficit

If you’re invested in an apartment syndication that collects $20,000 a month and expenses are $16,000, then your cash flow is $4,000 each month.

#2 Appreciation

Appreciation is the increase in the value of an investment property over time. It’s an important variable which plays a key role in defining the profit from a property for a real estate investor.

Whenever someone is considering investing in apartment complexes, they should pay attention to what improvements are being performed in order to increase the future value.

Many of the investments that are available to members of the Passive Investors Circle are called value-add properties.

This produces forced appreciation caused by the improvements made such as:

- painting

- landscaping

- remodeling

- parking lot repairs/replacements

- addition of new facilities (i.e. swimming pool, playground, etc.)

- addition of new services such as a laundry room, covered parking, internet, cable/satellite, etc.

By making these improvements, rent can gradually be raised over the normal 5-7 year hold period these deals have before turning around and selling them at a higher price due to this forced appreciation.

Income producing real estate, especially apartments, increase in value either because you physically improve the property, increase the rents, or reduce the expenses (or all of the above).

#3 Mortgage pay down

Typically the sponsors involved with apartment syndications use debt to finance them.

This is no different than using a mortgage to finance your home except for one main difference….regarding your home, you’re the one that has to pay the mortgage.

But in a multifamily investment, the tenants pay if off for you. This allows you to build wealth automatically and who wouldn’t like that?

Now that we’ve discussed three of the four main ways to make money in real estate, let’s turn our attention to the tax benefits and just how much we’re paying in taxes these days.

Join the Passive Investors CircleAmerica’s Tax Bill

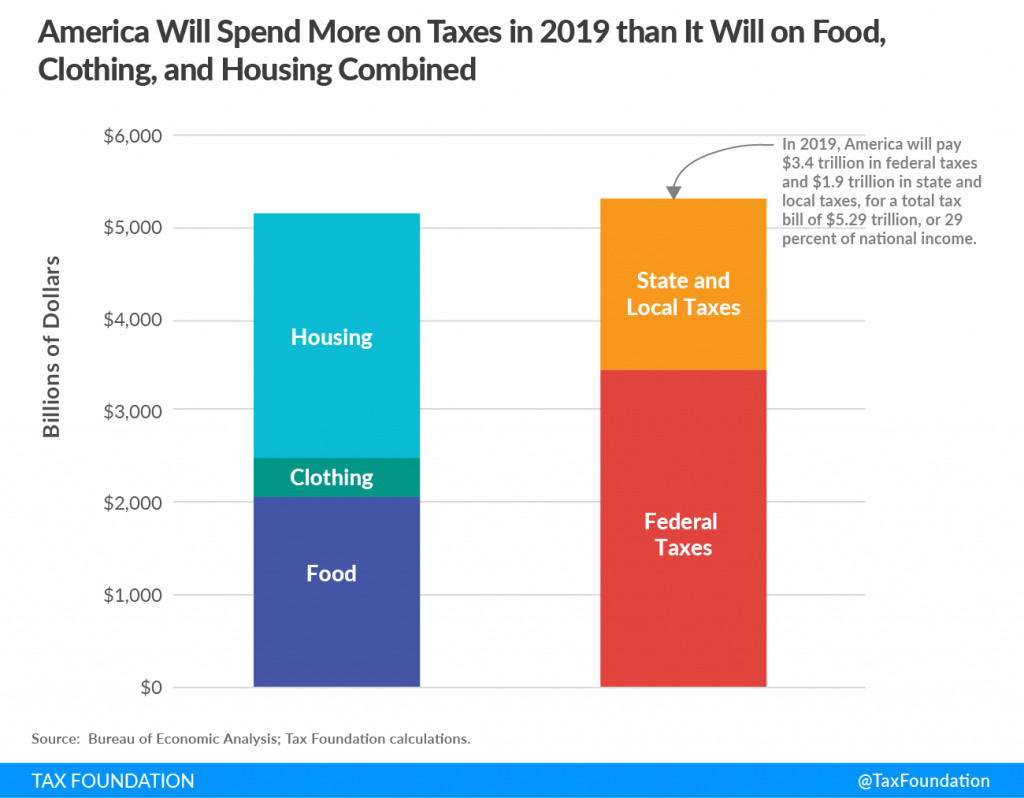

Let’s face it. During our careers, taxes will be our BIGGEST expense.

As a matter of fact, TaxFoundation.org shows that last year we paid over 5 Trillion in federal, state and local taxes.

This was MORE than we paid for our basic needs:

- food

- clothing

- shelter

By now you realize our nation as a whole pays a lot of taxes so let’s take a look at how real estate can help offset some of this.

5 Outstanding Tax Benefits Of Real Estate Investing

#1 Depreciation

Depreciation is one of the most powerful wealth building tools in real estate. Read that sentence again and let it really sink in.

It allows you to write off the value of an asset over time.

Instead of using real estate as an example, let’s use a computer. Once you buy a computer and put it into service, it immediately starts to go down in value. Over a period of 1,3 or 5 years, it really starts to lose its value.

Even though commercial real estate usually appreciates in value, the IRS allows you to depreciate its value called a paper or phantom loss.

They allow you to subtract the losses against the income which will REDUCE your tax burden.

Useful life

As you can imagine, every asset has a different lifespan.

For residential real estate, the IRS allows you to write off the value of the property over 27.5 years as they determine that to be its useful life.

For commercial real estate, the depreciation schedule is longer, 39 years.

Straight-line depreciation example

$4,000,000 property investment

- $200,000 Net operating income (NOI)

- No loan

When you go to depreciate the property, you’ve got to break it up into 2 areas:

- Land

- Building

Land is not depreciable which is why you must subtract out the land value.

If we take our $4,000,000 property and subtract out the land, then we can break it up into the following:

$4,000,000 – $1,250,000 = $2,750,000

- Land: $1,250,000

- Building: $2,750,000

The results

In this scenario (we’re assuming you’re in a 37% tax bracket), the IRS allows you to depreciate $100,000 a year over the next 27.5 years as a paper loss. ($2,750,000/27.5 yrs = $100,000)

Remember, the NOI was $200,000 but we’re NOT going to have to pay taxes on that amount. Why? Well you are allowed to subtract out that depreciation expense. ($200,000 – $100,000 = $100,000)

You’re only going to be taxed on the $100,000.

Tax without depreciation

$200K x 37% = $74,000

Tax with depreciation

$100K x 37% = $37,000

As you can see, with depreciation, the amount of taxes you have to pay are cut in half! That’s the power of depreciation.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter#2 Cost Segregation Study – Accelerated Depreciation

This is where the real tax savings occur. The IRS allows you to front load or accelerate the depreciation. This can be accomplished via a cost segregation study.

Instead of taking the property and dividing into 2 components (building and land), you now divide it into 4 components:

- Land

- Building

- Personal Property

- Land Improvements

So now, from the building, you’ve moved out personal property and land improvements.

Personal property is the non-permanently affixed items to the building such as: carpet, cabinets, drapes, etc. It gets depreciated either over 5 or 7 years.

Land improvements are just what it sounds like, any improvements to the land such as: parking lots, curbs, swimming pool, sidewalks, etc. It gets depreciated over 15 years.

Let’s continue using the above example:

- $4,000,000 property

- $1,250,000 land

We’re now left with the $2,750,000 building but we can break it up into personal property and land improvements.

$2,750,000 – $300,000 – $250,000 = $2,200,000 which is what the building is NOW worth

- $2,200,000 building/27.5 = $80,000

Remember, we’re allowed to depreciate $80,000/year for the next 27.5 years.

- $300,000 personal property/5 = $60,000

We can depreciate $60,000 each year over the next 5 years due to the personal property.

- $250,000 land improvement/15 = $16,670

We can depreciate $16,670/yr over the next 15 years due to the land improvement.

Total depreciation: $156,670 = ($80,000 + $60,000 + $16,670)

$200,000 – $156,670 = $43,330

We’re now only taxed on the $43,330!

Results

Tax without depreciation

$200K x 37% = $74,000

Tax with depreciation

$100K x 37% = $37,000

Tax with accelerated depreciation

$43,330 x 37% = $16,032

With using the accelerated depreciation, our tax bill lowers even more to $16,032.

I hope you’re starting to see how great adding real estate, even passive real estate, to your portfolio can be to grow your wealth.

#3 Bonus Depreciation

But wait…there’s MORE!!

Just when you thought it couldn’t get any better, it actually does!

Bonus depreciation is a form of accelerated depreciation. Instead of taking something over a 5,7 or 15 year depreciation, you’re benefit can be taken in the FIRST YEAR.

Say what?

The Tax Cuts and Jobs Act in 2017 was passed that stated if property was or is purchased from 9/28/17 to 12/31/22 then you can get a first year 100% benefit.

Unfortunately, this benefit is going to get phased out by 20% each year through 2026.

Let’s revisit our example:

- $4,000,000 property

- $1,250,000 land

- $2,200,000 building/27.5 = $80,000

- $300,000 personal property / 5 = $300,000

- $250,000 land improvement / 15 = $250,000

Now, instead of taking the personal property and dividing it by 5 and taking the land improvement and dividing it by 15, we can take the entire benefit in year one.

$80,000 + $300,000 + $250,000 = $630,000 in paper loss which easily cancels out the $200,000 in gains. As a matter of fact, not only does it erase it, it leaves you with $430,000 of depreciation that first year.

Total depreciation: $630,000

$200,000 – $630,000 = -$430,000

Join the Passive Investors CircleResults

Now with the bonus depreciation, it’s entirely wiped out the $200,000 so you’re tax on $0 is zero!

Tax without depreciation

$200K x 37% = $74,000

Tax with depreciation

$100K x 37% = $37,000

Tax with accelerated depreciation

$43,330 x 37% = $16,032

Tax with Bonus Depreciation

$0 x 37% = $0

#4 The 1031 Exchange

The term 1031 Exchange is defined under section 1031 of the IRS Code. This is one of the most quoted tax benefits of real estate investing.

This strategy allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long another “like-kind property” is purchased with the profit gained by the sale of the first property.

Real estate mogul Grant Cardone gives us the 1031 exchange timeline plus a specific example from one of his callers in the video below:

Capital gains taxes

The deferred taxes are the capital gains taxes upon selling the property. The IRS is ALWAYS going to want a piece of your newfound wealth. These so called “windfalls” are what’s considered capital gains and most are taxed at 15-20%.

As far as how long they’re deferred for….it could be indefinitely, or at least until you die. As long as you follow the IRS rules, you can defer those taxes forever and ever.

1031 Exchange Timeline And Steps

I’d recommend that you use a 1031 intermediary and/or consult with a tax attorney before attempting this on your own.

Here’s a break down of the 1031 exchange timeline:

1) Exchange (sell) one investment property for another (like-kind). It must be real estate for real estate.

2) The property that is going to be replacing the original property must be of equal or greater value.

3) Here’s where we get into the rules of the 1031 exchange timeline.

- Timeline #1 – You have 45 days after you sell your property to identify up to 3 new properties. This can be done in writing but you have to purchase one or more of them.

- Timeline #2 – You have 180 days to close on one or more of the three properties that were identified.

4) In order to assist with this process, an intermediary has to help. This means that all the funds need to go through a neutral party.

5) After agreeing on a sales price, your intermediary must wire the capital gains to the title holder/company.

6) Fill out the appropriate IRS form 8824.

In essence, this section allows you a way to defer taxes by exchanging one property and replace it with a like-kind property. Basically you’re able to take all of the proceeds from the sale of one property and buy another and the taxes on the transaction are deferred.

#5 No Self-Employment or FICA Taxes

Good news! Rental income is not subject to social security and Medicare taxes.

Depending on whether you practice in a group or are self-employed, you could be paying anywhere from 7.65% to 15.3% toward this FICA tax on other income.

The tax is in the amount of 15.3% and it is split 50/50 between the employer and the employee.

If you’re self-employed like myself and have no employer, you’re responsible for the full 15.3% self-employment tax.

Again, this might depend on how you classify your self-employment (example S vs C), but that 15.3% could be a significant amount. It just goes to show that all income is not treated equal.

It’s a reason to push for more passive income sources–particular those designated as such in the eyes of the IRS.

Summary

Whether you’re currently a real estate investor or not, it’s never a bad idea to begin learning about the tax benefits of real estate investing.

Are you ready to start learning about how you can lower your tax bill with real estate investing?

Join the Passive Investors Circle today.