What Is The 1031 Exchange Timeline?

As healthcare professionals, one of the biggest expenses that we’ll pay each year is taxes. I see too many docs overpaying in taxes when they shouldn’t be. Why? Because they’re not doing the extra work that it takes to do so.

Now, I’m not talking about seeing more patients.

Not that kind of work.

The work I’m talking about is doing everything that they “legally” can to NOT have to pay the IRS any extra money. Why would you want to loan them YOUR money interest free for a year or more?

Most of us wouldn’t even do it for a few of our relatives. Come on man!

Here’s a break down of that extra work to lower the tax bill:

For starters, I’d ask wealthy people in your area which CPA they use. When I say wealthy, I’m talking about the multi-multi-millionaires (not the everyday millionaire). Rich folks don’t like paying any more taxes than they have to. So they’re going to use the best accountants that are able to reduce their tax bills.

Now after you talk to a few of them, you’ll find most are going to be using the same one or two accountants.

As a side note….we switched last year to a group that was recommended by other docs that also invest in real estate too. It makes me sick to think about all of the extra taxes that I’ve paid in the past that we didn’t have to had I been with this new group.

Live and learn.

Another way to lower your taxes is to invest in what these same wealthy people invest in….real estate. Why? It’s one of the best investing vehicles that not only can provide you multiple streams of income, but it can also help lower your overall tax bill.

One of the specific ways to lower taxes is by using what’s called a 1031 exchange. Not only can it help with taxes, it also can help you to accelerate your way to a quicker financial freedom status. And we all want that, right?

What Is A 1031 Exchange?

Real estate mogul Grant Cardone gives us the 1031 exchange timeline plus a specific example from one of his callers in the video below:

The #1 reason I wanted to share this information with you today is that it could be the MOST powerful wealth-building tool available. Hands down.

This tax incentive comes straight from Section 1031 from the IRS.

Here’s the definition from IRS.gov regarding 1031 exchanges which is also known as “Like-Kind Exchanges“:

Like-kind exchanges — when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or “like-kind” — have long been permitted under the Internal Revenue Code.

Generally, if you make a like-kind exchange, you are not required to recognize a gain or loss under Internal Revenue Code Section 1031.

In essence, this section allows you and me, the taxpayers, a way to defer taxes by exchanging one property and replace it with a like-kind property. Basically you’re able to take all of the proceeds from the sale of one property and buy another and the taxes on the transaction are deferred.

You maybe asking yourself:

- What types of taxes are deferred?

- How long are they deferred for?

The deferred taxes are the capital gains taxes upon selling the property. The IRS is ALWAYS going to want a piece of your newfound wealth. It always seems like they don’t want anyone to succeed doesn’t it? Anyway, these so called “windfalls” are what’s considered capital gains and most are taxed at 15-20%.

As far as how long they’re deferred for….it could be indefinitely, or at least until you die. As long as you follow the IRS rules, you can defer those taxes forever and ever. Good stuff!

Now you see why wealthy people utilize this strategy.

The one sticking point of a 1031 is that both the purchase price and the new loan amount has to be the same or higher on the replacement property.

1031 Exchange Example

Here’s Grant Cardone’s example from the above video:

This person sold an investment property for $750,000, originally took out a $500,000 loan leaving him with $200,000 of equity.

The next exchange MUST cost $750,000 or more, have at least $500,000 of debt and the $200,000 of equity can’t be touched. If you do touch any of the equity, it will then be taxed.

So this rule allows you to take the entire amount of equity, defer the taxes, and apply ALL of it on the purchase of another property. It only takes doing a handful of these to really get the snowball rolling.

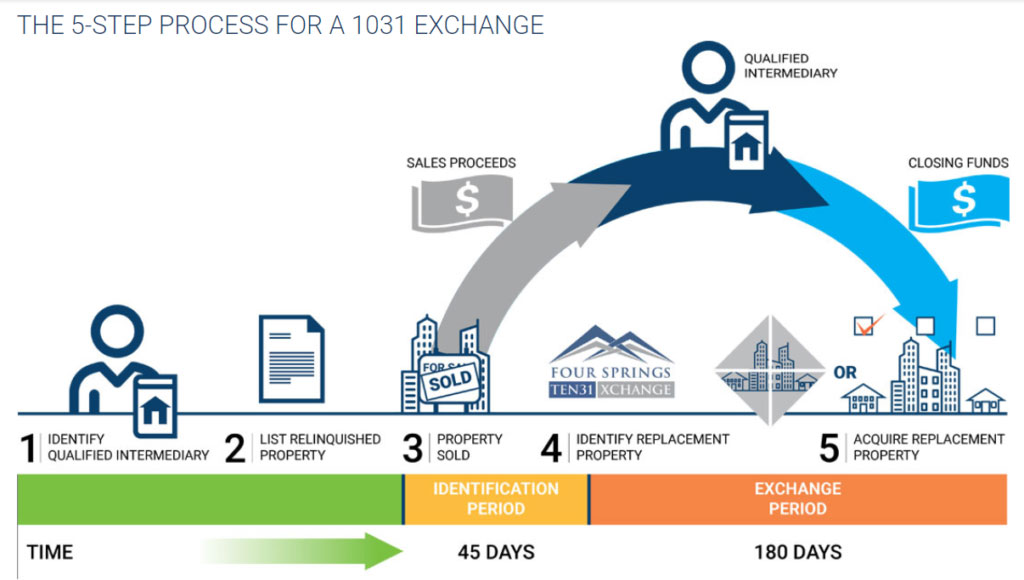

1031 Exchange Timeline And Steps

I’m NOT a tax attorney and would strongly recommend that you use professional help before thinking about doing this yourself. The risk versus reward is too great trying to DIY and you want to make sure you’re being compliant with each step.

1) Exchange (sell) one investment property for another (like-kind). It must be real estate for real estate, not real estate for a new hunting vehicle 🙂

2) Remember, the property that is going to be replacing the original property must be of equal or greater value.

3) Here’s where we get into the rules of the 1031 exchange timeline.

- Timeline #1 – You have 45 days after you sell your property to identify up to 3 new properties. This can be done in writing but you have to purchase one or more of them.

- Timeline #2 – You have 180 days to close on one or more of the three properties that were identified.

4) In order to assist with this process, an intermediary has to help. This means that all the funds need to go through a neutral party.

5) After agreeing on a sales price, your intermediary must wire the capital gains to the title holder/company.

6) Fill out the appropriate IRS form 8824.

1031 Exchange Visual Overview

Are You Inspired Now?

Are You Inspired Now?

The more I study the “wealthy,” the more I realize that the majority of their money is made in real estate.

Not only is it a great vehicle to make money, but now you realize one of the ways it allows you to defer taxes.

I encourage you to continue educating yourself on real estate investing as this can be a key part of your wealth building strategy.